The first half of 2024 revealed important trends and shifts in Canada’s farmland real estate market, as highlighted in Farm Credit Canada’s (FCC) 2024 Mid-Year Farmland Values Report. These findings build on the dynamics observed in its 2023 report while reflecting the evolving economic environment, including interest rate fluctuations and commodity market adjustments.

Background: The 2023 Farmland Landscape

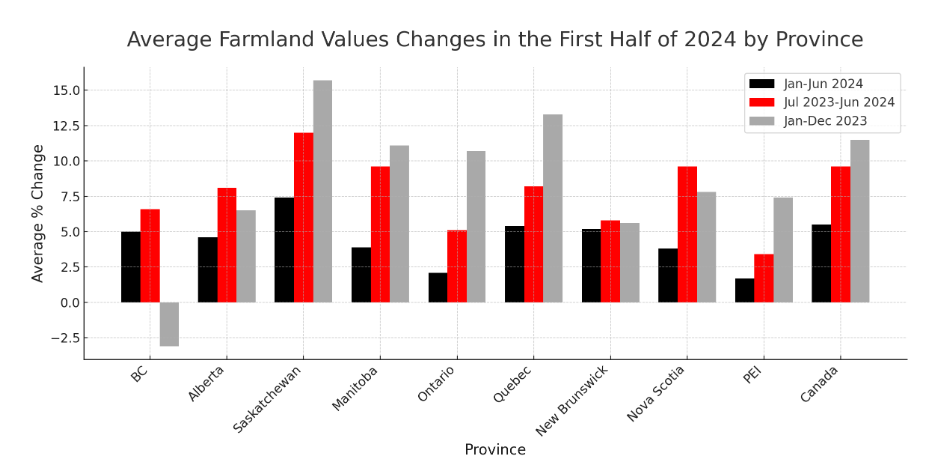

In 2023, Canadian farmland values rose significantly, with an average increase of 11.5% across the country. Despite elevated interest rates and high farm input costs, farmland demand remained strong due to limited availability. Saskatchewan, Quebec, and Manitoba led the country in value growth, with increases of 15.7%, 13.3%, and 11.1%, respectively.

Farmland rental rates, which remained largely unchanged in 2023, offered a financial advantage over purchasing, as renting reduced cash flow pressures and minimized financial risk for farmers. Meanwhile, the growing involvement of investment funds and private equity firms in farmland acquisitions showed a diversification in market participants.

Irrigation capabilities played a critical role in influencing land values in drought-prone regions like Manitoba, Alberta, and Saskatchewan.

Mid-Year 2024 Highlights

While farmland values continued to rise in the first half of 2024, the pace of growth slowed compared to previous years. According to FCC’s 2024 Mid Year Farmland Report, cultivated farmland values increased by an average of 5.5% between January and June 2024, marking a deceleration from the sharp annual increases of 2022 and 2023. Over the 12 months ending in June 2024, farmland values rose by 9.6%, reflecting the combined influence of limited supply, elevated borrowing costs, and other economic factors.

Regional Variations in Farmland Value Growth in H1 2024

In the Prairies, Saskatchewan recorded the highest six-month growth rate at 7.4%, continuing its dominant position in Canada’s farmland market. Northern and central regions led the province in appreciation, with smaller gains observed in southern areas. Alberta experienced a 4.6% rise. Trends in Alberta have shifted to an increase in smaller land parcels being sold as large holdings are divided, with transactions often occurring via private sales, live auctions, or sealed tenders. Manitoba showed a slower growth rate of 3.9%, marking a decline from its strong performance in 2023.

Quebec saw a 5.4% increase in the first half of 2024, driven by growth in regions like Mauricie-Portneuf and Centre-du-Québec. However, areas with the highest per-acre land values experienced modest gains.

British Columbia rebounded from a 3.1% decline in 2023 to record a 5.0% growth rate by mid-2024, with the Peace-Northern region driving provincial averages.

Ontario, Nova Scotia, and Prince Edward Island saw more subdued growth, with increases of 2.1%, 3.8%, and 1.7%, respectively. In Ontario, high-quality farmland sold better, while average to lower-quality land struggled. The Central West region saw the largest increase in land values, while the Mid Western region showed no growth.

Key Market Drivers in 2024

Farm revenues continue to be an essential factor in farmland value trends. High input costs, such as for fertilizer, fuel, and other essentials, have been squeezing farmers’ profit margins. This is limiting the ability to invest in new land, which may slow the pace of farmland value growth. However, in the short term, strong farm cash receipts in 2023 likely supported the farmland value growth seen in the start of 2024.

Economic pressures, including elevated interest rates during the first half of 2024 and the anticipation of future rate reductions, along with falling commodity prices, have affected both the agricultural industry and farmland real estate markets.

The scarcity of farmland for sale continues to exert upward pressure on values, reinforcing the appeal of agricultural real estate as a resilient asset class.