Last Updated on February 24, 2024 by CREW Editorial

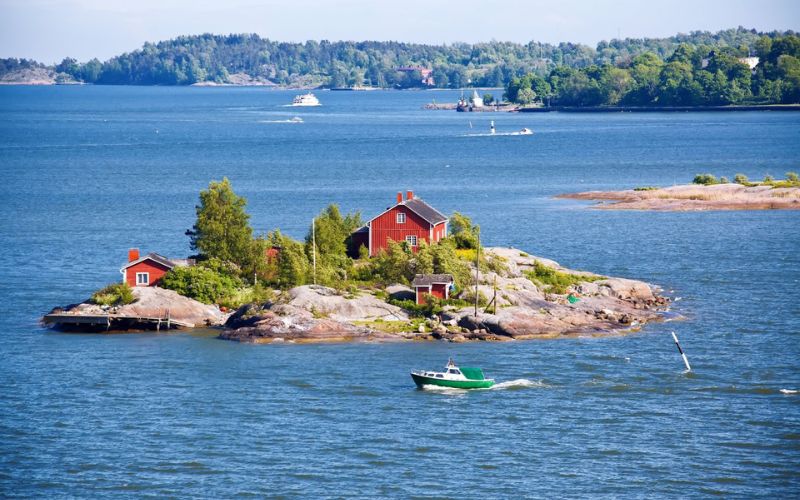

Selling your second home can be both an exciting and daunting process, especially when it comes to understanding the tax implications. The gain on the sale of real estate, such as your summer cottage or rental home, is typically considered a capital gain. But, only 50% of this gain is taxable, which can significantly impact your financial planning.

Exploring the tax world requires a solid grasp of how these gains are taxed and the opportunities available to minimize your liability. Whether it’s leveraging the principal residence exemption to reduce taxable gains or exploring investment property classifications, understanding the nuances can lead to substantial savings. Let’s jump into the intricacies of capital gains on second home sales and unravel the strategies to optimize your returns.

Understanding Capital Gains on Second Home Sale

When you sell a second home, such as a vacation property or a rental unit, the profit you make is considered a capital gain. Capital gains are the difference between what you sold the property for and its adjusted cost base (ACB), which includes the purchase price and any capital improvements you’ve made.

In Canada, only 50% of your capital gain is taxable. For example, if your capital gain on the sale is $120,000, you’ll only need to include $60,000 in your taxable income. This favourable tax treatment can significantly impact your overall tax liability, making strategic financial planning essential.

It’s crucial to accurately calculate your property’s ACB to ensure you’re not paying more tax than necessary. Capital improvements, such as replacing a roof or installing new windows, increase the ACB and reduce your taxable gain. Remember, the cost of these improvements must be substantiated with receipts and records.

Exploring the complexities of capital gains tax requires a keen understanding of relevant tax laws and regulations. Working with professionals, like tax experts or financial planners, can help optimise your property’s designation and ensure that you make the most informed decisions for your situation.

Factors Affecting Capital Gains

When delving into the area of selling a second home, understanding the factors that influence capital gains is imperative. These elements can significantly impact the amount of tax you’ll owe to the government.

Property Value

The property value is a cornerstone factor affecting your potential capital gains. Essentially, the higher the selling price relative to your purchase price, the larger your capital gain. It’s a straightforward calculation: Capital Gain = Selling Price – Purchase Price. Market trends play a pivotal role in determining your property’s value at the time of sale. If the market is bullish, property values in the area may soar, leading to substantial capital gains. Conversely, in a bearish market, gains might be minimal or non-existent. Renovations and improvements also enhance property value, thereby potentially increasing capital gains. Upgrades such as kitchen renovations, bathroom improvements, and energy-efficient additions can add considerable value to a property.

Length of Ownership

The Length of Ownership influences the capital gains tax on a second home in two fundamental ways. Firstly, the longer you own the property, the more potential it has to appreciate in value. Historic data suggest that real estate markets generally trend upwards over long periods. Hence, a property held for several years is likely to increase in value, potentially leading to a higher capital gain when sold.

Secondly, the duration of ownership affects the tax rate applied to your capital gain. In some jurisdictions, long-term capital gains, which are gains on assets held for more than a specified period (e.g., over a year), are taxed at a lower rate compared to short-term capital gains. This distinction underscores the importance of timing in your sale strategy to maximise the benefits from favourable tax treatments.

Understanding these factors and how they intertwine with market dynamics and tax regulations is crucial for any property owner considering the sale of a second home. By keeping these key aspects in mind, you can better navigate the complexities of capital gains and make informed decisions that contribute to your financial well-being.

Capital Gains Tax Calculation

When you sell your second home, understanding how capital gains tax is calculated is crucial to ensuring you’re not caught off guard. This section will guide you through the essential elements of the calculation process, including deductible expenses, capital gains tax rates, and potential tax exemptions.

Deductible Expenses

When calculating the capital gains on the sale of your second home, it’s important to factor in the deductible expenses. These are costs directly related to the sale and purchase of the property that can reduce your taxable gain. Key deductible expenses include:

- Legal fees

- Broker’s commissions

- Surveyor’s fees

- Transfer taxes

These expenses get subtracted from the proceeds of the sale, thereby reducing the total gain on which you are taxed. Accurately accounting for these can significantly impact your capital gains calculation, leading to a lower tax bill.

Capital Gains Tax Rates

Your capital gains tax rate is contingent upon your income bracket and the province where you reside. In Canada, 50% of your capital gain is subject to taxation at your marginal tax rate.

It’s pivotal to understand that the above rates apply to the 50% of your capital gain that is taxable. Successfully exploring through these rates requires a clear understanding of your specific tax obligations in your province.

Tax Exemptions

There are scenarios where you might be exempt from paying capital gains tax, or your tax obligation could be significantly reduced. For instance, if you’ve used your second home as your primary residence for a portion of the ownership period, you may qualify for the Principal Residence Exemption (PRE) for those years. This exemption can substantially decrease your taxable capital gain and is something to consider when calculating your taxes.

Also, if you’ve made any improvements or additions to the property, these are not considered deductible expenses but instead increase the property’s Adjusted Cost Base (ACB), potentially reducing the capital gain.

Understanding these components of capital gains tax calculation can significantly affect your financial planning and tax strategy.

Reporting Capital Gains

When you sell your second home, reporting capital gains is a crucial step in ensuring compliance with Canadian tax laws. On Schedule 3 of your tax return, all capital gains and losses from real estate transactions must be declared. This includes any sale involving land or buildings, such as residential properties, vacation homes, rental units, and commercial buildings.

- Sale Allocation: If the sale involves both a structure and the land it occupies, it’s essential to apportion the sale price accurately between the two. This ensures that capital gains are correctly calculated and reported for each component.

- Schedule 3 Filing: Accurately completing Schedule 3 is pivotal. For each property sold, details such as the purchase price, selling price, dates of acquisition, and sale must be meticulously recorded.

The formula for calculating capital gain on property sale is straightforward: Capital Gain = Selling Price – Purchase Price. It’s imperative to account for any allowable expenses that can adjust these figures, such as legal fees, renovations, and property improvements, as they directly affect the capital gain reported.

By understanding and correctly applying these reporting requirements, you position yourself to efficiently manage any tax implications arising from the sale of your second home.

Can you claim a rental loss?

When you own a second property intended for rental, you’re likely exploring every avenue to optimise your returns, which includes managing financial losses effectively. It’s critical to understand that to claim a rental loss on your property, the Canada Revenue Agency (CRA) requires proof of your efforts to generate rental income. This means actively advertising the property and ensuring that the asking rent aligns with current market rates.

Even if your property is currently vacant, you can still claim a rental loss. But, this is contingent upon demonstrating a genuine effort to rent it out. A failure to meet this criterion can result in the denial of your rental loss claim. It’s essential not only to show that you have made attempts to find tenants but also to maintain thorough documentation of these efforts. This documentation should include advertisements placed, communications with potential tenants, and any other actions taken to secure rental income.

Understanding how to navigate the tax implications of owning a second property, whether for personal use or as a rental, is invaluable. The tax world can be complex, but staying informed and compliant with CRA requirements ensures you can manage your property in a financially efficient manner.

Conclusion

Exploring the tax implications of a second home in Canada requires a keen understanding of CRA’s expectations. By ensuring you’re actively attempting to rent out your property and keeping meticulous records of these efforts, you’re not just complying with regulations but also safeguarding your financial interests. Remember, the key to a successful rental loss claim lies in your ability to prove genuine attempts to generate income. Armed with this knowledge, you’re better positioned to manage your property’s tax obligations effectively.

Corben joined CREW as a relative newcomer to the field of real estate and has since immersed himself and learned from the experts about everything there is to know on the topic. As a writer with CREW, Corben produces informative guides that answer the questions you need to know and reports on real estate and investment news developments across Canada. Corben lives in Guelph, Ontario with his partner and their two cats. Outside of work, he loves to cook, play music, and work on all kinds of creative projects. You can contact Corben at corben@crewmedia.ca or find him on Linkedin at https://www.linkedin.com/in/corbengrant/.