Last Updated on October 24, 2023 by Corben Grant

One of the biggest discussion points in real estate is home prices, both for real estate professionals and regular people. But while trends can be similar in different areas, actual prices in the housing market vary greatly across Canada. Sure, major Canadian cities have high prices but this has kind of always been the case. In this article, we will look at prices in more detail in different areas and see how they compare across the country.

What is the average home price in Canada?

According to data from the Canadian Real Estate Association (CREA), the average home price in Canada from September of 2021 was $686,650. Other than to say this price was up over 13% from last year, this statistic is not highly useful for home buyers. The problem with a national average is it doesn’t take into account the large variation between specific markets in Canada or the price difference between different property types. For example, Toronto and Vancouver have such high prices and account for such a large amount of home sales volume in Canada that removing their data from the average drops the national average by almost $150,000.

For each province, and each major city in each province, we will report the most up-to-date average house price. Where they exist, we will also offer some more affordable alternatives nearby.

We will also include a figure for average household income as a way to see how affordability stacks up across provinces. The greater the ratio between the average home and the average household income, the less affordable the housing market is.

British Columbia

In British Columbia, the average home price in September 2021 was $913,471. The lowest average house prices in the province are to be found in the areas in the north with house prices just under $400,000 on average. The average income in British Columbia is around $53,400, meaning the price of a home is about 17x the average income.

Vancouver

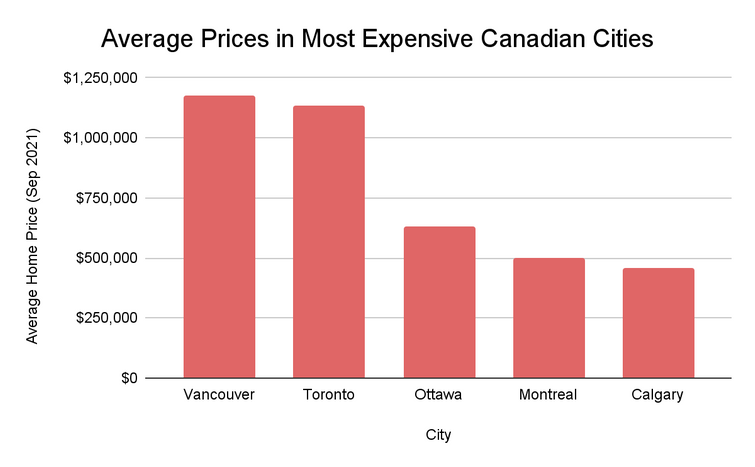

The most expensive region in British Columbia was Vancouver with an average home price of $1,174,000 according to BCREA. Vancouver is one of the hottest and most expensive housing markets in Canada. The city is the major hub of Canada’s west coast and benefits from a lot of business as a result. People are also attracted to the city for its favourable climate and proximity to both the mountains and the sea.

Popular alternatives to Vancouver

According to a report by Zolo.com, the most affordable large cities in BC are Nanaimo and Kamloops. Both offer similar benefits to the city of Vancouver with much more affordable house prices than the Vancouver housing market.

Alberta

In Alberta, the average home price in September 2021 was $401,705. The average income in Alberta is around $61,800, meaning the average home price is about 6.5x the average income. Alberta is known for being an agricultural and industrial powerhouse, with some of the highest household incomes in Canada.

Calgary

The most expensive housing prices in Alberta are in the city of Calgary with an average home price of $460,100 according to the Calgary real estate board. The city has had historically lower prices than other major Canadian cities, making it a .

Alternatives to Calgary

Alberta’s other major city, Edmonton, saw average prices of $377,554, making it a significantly cheaper city for real estate than Calgary.

Cities such as Airdrie, Red Deer, and Lethbridge are near enough to Calgary while managing to be much more affordable. For example, the average home in Airdrie costs $395,300, over $60,000 cheaper than Calgary proper.

Saskatchewan

In Saskatchewan, the benchmark home price in September 2021 was $286,600. The average income in Saskatchewan is around $54,300, meaning the benchmark price of a home is about 5x the average income. The least expensive homes in Saskatchewan are in the areas of North Battleford and Melville with prices well below $200,000.

Regina

Regina is the most expensive city in Saskatchewan, though real estate in the city and the province, in general, are more affordable than other areas in Canada. A home in Regina is $335,656 on average.

Saskatoon

Saskatoon, Saskatchewan’s other major city and the province’s largest, is comparable in price to Regina, though homes were marginally cheaper on average.

Manitoba

In Manitoba, the average home price in September 2021 was $321,504. The average income in Manitoba is around $49,600, meaning the average home price is about 6.5x the average income.

Winnipeg

Winnipeg is Manitoba’s largest and most expensive city. The average price for a detached home according to the Winnipeg Regional Real Estate Board was $364,817 in September 2021.

Ontario

In Ontario, the average home price in September 2021 was $887,290. The average income in Ontario is around $55,500, meaning the average home price is about 16x the average income. Ontario is the most populous province in Canada and is very densely populated in the south. The cheapest homes in Ontario were located in the “north” (an area that technically starts in the southern end of the province) such as in Thunder Bay and Sudbury.

Toronto

Along with Vancouver, Toronto is one of the largest real estate markets in Canada. The average price for a home in Toronto was $1,136,280, making it the second most expensive city in the country. Toronto is Canada’s largest city and draws a lot of domestic and international attention, thus commanding high prices for real estate.

Alternatives to Toronto

There are many other cities in the province if you are looking for something cheaper than Toronto. The largest of these cities would include Ottawa and Hamilton who had prices of $629,112 and $876,000 respectively.

Generally, due to the massive draw of Toronto and Ottawa, there are numerous communities in southern Ontario that can easily access these major cities. The prices in these communities essentially decrease the farther you get from Toronto or Ottawa (excluding the vacation home areas around Muskoka.)

Quebec

In Quebec, the average home price in September 2021 was $459,955. The average income in Quebec is around $51,700, meaning the average home price is about 8.8x the average income.

Montreal

Montreal is easily the most expensive city in Quebec due in part to being the second-most populous city in Canada. A single-family home in Montreal for September 2021 sold for a median price of $500,250.

Alternatives to Montreal

Quebec has no shortage of more affordable alternatives to its largest city. Popular choices include Gatineau which is nearby to Ottawa, and Quebec City, also a popular tourist destination. These cities had average single-family home prices of $440,392 and $362,490 respectively.

Newfoundland and Labrador

In Newfoundland and Labrador, the benchmark home price in September 2021 was $321,700. The average income in Newfoundland and Labrador is around $55,500, meaning the benchmark price of a home is about 5.7x the average income.

St.Johns

The benchmark price of a home in St.Johns was $296,200 as of September 2021. As the largest city in the province, its real estate is the most in-demand.

New Brunswick

In New Brunswick, the benchmark price of a home in September 2021 was $262,200. The average income in the province is around $49,500, meaning the benchmark home price is about 5.2x the average income.

Moncton

Moncton is the most expensive city in New Brunswick with average home prices coming in at $290,949. However, most urban areas in New Brunswick have similar home prices, with Saint John and Fredericton coming in at $273,313 and $241,009 respectively.

Prince Edward Island

In PEI, the average home price in September 2021 was $335,202. The average income in PEI is around $45,900, meaning the average home price is about 7.3x the average income. Unfortunately, data for individual communities in PEI is not easy to find as the province’s small size does not make this a viable or necessary data point.

Nova Scotia

In Nova Scotia, the average price of a home in September 2021 was $356,757. The average income in Nova Scotia is around $48,400, meaning the average home price is about 7.3x the average income.

Halifax

The most expensive city in Nova Scotia is Halifax with an average home price in September 2021 of $471,746, or more than $100,000 more expensive than the provincial price. In the past couple of years, Halifax has seen big gains from to enjoy better home prices in the city, which ironically may have contributed to the much higher home prices.

Alternatives to Halifax

Nova Scotia’s second-largest city, Cape Breton, had an average price of $202,612 in the same period. Though much cheaper, it’s also a much smaller city than Halifax and will likely attract a very different lifestyle. For investors interested in Atlantic Canada generally, it may be worth taking a look at more affordable cities in nearby provinces as the relatively small size of these provinces makes travelling between them much easier.

Canadian house prices summary

Generally, the most expensive real estate is found in the largest (and, therefore, most in-demand) cities of each province. Across Canada, the highest housing prices are then in the largest cities for the same reasons.

Though the major cities tend to be more expensive, an investor should also recognize the possible financial benefits of rising home prices and higher rental demand. Big cities may provide the best ROI, but you will need much more starting capital to get into the housing market.

In some cases, the high price point may make these investments unrealistic for you, so remember that Canadian real estate is still a good investment outside of major metropolitan areas. In fact, in these areas, a smart investor can make very good money on lower-priced homes.

*all prices are subject to change

Corben joined CREW as a relative newcomer to the field of real estate and has since immersed himself and learned from the experts about everything there is to know on the topic. As a writer with CREW, Corben produces informative guides that answer the questions you need to know and reports on real estate and investment news developments across Canada. Corben lives in Guelph, Ontario with his partner and their two cats. Outside of work, he loves to cook, play music, and work on all kinds of creative projects. You can contact Corben at corben@crewmedia.ca or find him on Linkedin at https://www.linkedin.com/in/corbengrant/.