Last Updated on October 24, 2023 by Zee Jeremic

The title of “Canada’s most expensive city” has cycled between Toronto and Vancouver for decades. Though Toronto was reported to have the highest cost of living among all other cities in the country, in 2018, Mercer Canada’s annual cost-of-living survey now suggests that Vancouver has once again claimed the country’s number one spot, effectively bumping Toronto back to number two. But just how much does the cost of living affect the nature of the condo real estate market in both of these cities? Does Toronto’s lower cost of living make for better condo deals?

What About Traditional Housing?

In both Toronto and Vancouver, condominiums have taken sizeable shares of the real estate market. This is largely because traditional single-family housing options have become an unreachable goal for most homebuyers. The housing market is no longer a place for most new investors to plant their feet.

The sky-high rates at which Toronto/Vancouver homes are being sold make housing real estate a game that only current home-owners, or the rich, can play. In Vancouver alone, the average price for a home is currently at $1.3 million, with some three-bedroom homes reaching up to $2.2 Million.

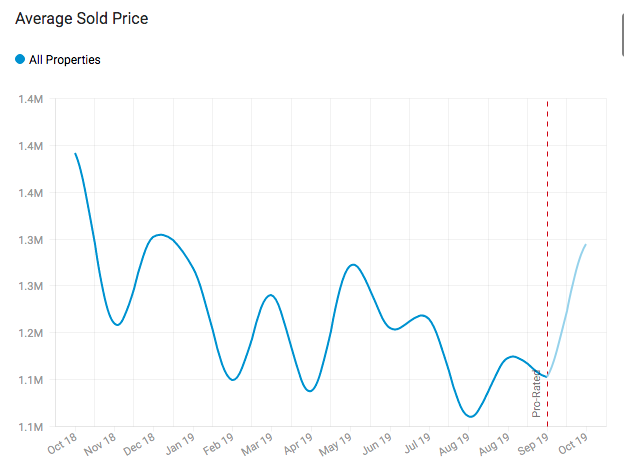

Take a quick look at the average price – this includes all residential property types – in Vancouver.

Chart courtesy of Zolo.

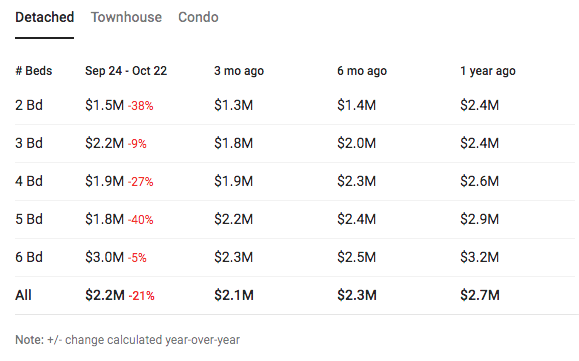

And here’s the average sale price of detached homes in Vancouver:

Figures courtesy of Zolo.

Toronto’s housing market isn’t much better. The selling price of the average Toronto home is $948,000, with three- to four-bedroom homes reaching prices of nearly $2 million. Slowed housing development in both of these urban areas means that these prices aren’t likely to fall anytime soon. In fact, Vancouver prices will continue to rise.

The Rise of the Condo

Developers have for years been building condominiums all over Toronto and Vancouver. The multitude of available new units and the seemingly competitive pricing are enticing draws for new investors looking to buy. (Not that condo developers have to try too hard to make their product viable. The housing market has done that work already.) But with all these options, in what city would a hopeful investor be able to get the best deal?

If you’re looking for a property to live in, Vancouver’s condominium prices will certainly pique your interest.

At first. But let’s take a second glance…

Plenty of news outlets over the past year have reported Vancouver’s condo prices are illustrating sizeable decreases. It’s true: Vancouver’s average per-square-foot price has fallen far further than any other major real estate market in Canada this year. Condos at the heart of the city have dropped by roughly 6.3% and are selling for approximately $1,044 per square foot. Unfortunately, this is not as exciting as the media makes it sound.

Though there has been a notable dip in Vancouver condo pricing, the city’s units are still the most expensive in the country.

But what about Toronto? Well, Toronto condominiums have been in extremely high demand thanks to the city’s large population of millennial buyers, who can’t afford much else. If the country’s largest generation wasn’t enough to get developers building at hyper-speed, Toronto’s similarly large cohort of baby boomers are also interested in buying a condo in order to downsize.

All this demand has spiked the average listing price for condo units in Toronto. The average price per square foot in the GTA rose by roughly 9.1% percent as of August last year, meaning the average square foot for Toronto condos is now at about $743. Despite their opposite pricing trends, Toronto condominiums remain the more affordable buying option.

Comparing the Vancouver and Toronto rental markets

You may assume that if you’re buying a condo purely as a rental property, Vancouver would be the right choice. And why not? After all, Vancouver has the highest unit prices in the country. Shouldn’t owning a rental property give you a quicker return on investment?

Not necessarily.

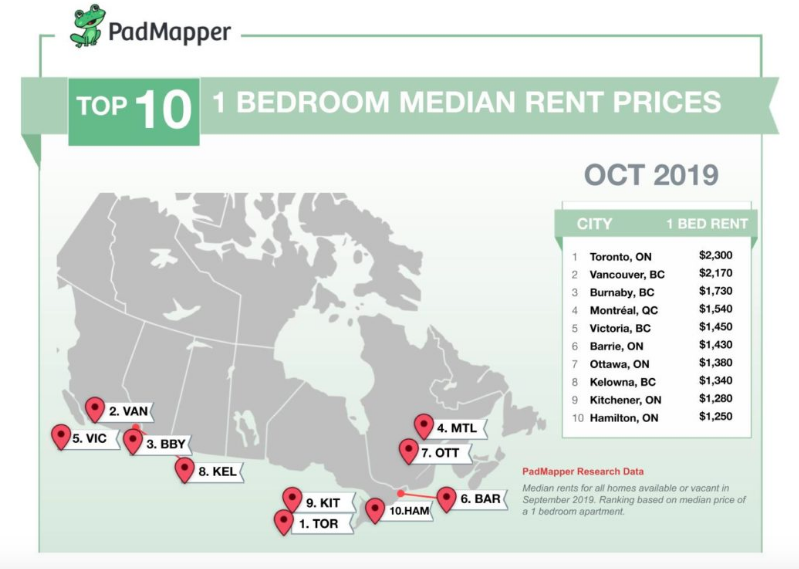

A recent report by Padmapper shows that Toronto has the most expensive rental market in the country. In fact, Toronto’s average rent for a 1-bedroom apartment trumps Vancouver’s average one-bedroom price by $130.

Graphic courtesy of Padmapper

In Toronto, you can buy a condo for less money and collect over $1,500 more annually in rent. There are many reasons for this. The first is cost of living. Vancouver’s high cost of living means that its products and services cost more than they do in other Canadian cities. Vancouver renters are more careful to consider the amount they’ll spend on monthly rent when they have other high monthly costs to think of.

Toronto condos also allow their residents more access to fine goods and services. The city has an abundance of restaurants, entertainment attractions, and shopping centers that provide a convenient living for Torontonians. The closer to the city you are, the more amenities you have easy access to. Landlords include the price of convenience in their rent prices. Is your property near the city’s subway system? All the more reason to increase your monthly rent.

The verdict: Should I buy in Vancouver or Toronto?

If you’re looking to turn a profit, or at the very least, find the best deal on a condominium, you should turn to Toronto’s available unit options. The numbers don’t lie: despite the price increases, Toronto’s condo units are more affordable than condos on the west coast. If you’re looking to become a landlord, Toronto’s average monthly rents will allow you to turn more of an annual profit.

Zee Jeremic works as a Marketing Manager for property management company Del Condominium Rentals Inc. While advertising is his primary job function by day, Zee also enjoys spending time with his family, hiking and salsa dancing.