Last Updated on October 24, 2023 by Steve Randall

Having a sufficient down payment to afford the home they want is the largest concern of first-time buyers according to a new survey.

The poll of recent homebuyers by mortgage insurer Genworth Canada and real estate brokerage Royal LePage found that 57% of respondents nationwide ranked that as their top fear before buying their first home.

Those in Toronto were most concerned about their down payment power (68%) while Vancouverites were less so (58%). But in Montreal, even with home prices around a third of those in Vancouver, 60% were concerned that their down payment was too small.

“While interest rates remain historically low, it is not surprising that first-time home buyers in Montreal are increasingly concerned about their down payment,” said Phil Soper, president and chief executive officer, Royal LePage. “Montrealers have been watching home values escalate over the past three years. Many are wondering if they have time to grow their down payment or if they should get in the market now as prices continue to rise.”

First-time buyers are willing to trade space for a shorter commute with 48% preferring this while 32% want a larger home even if they have to travel further to work.

Even in cities where first-time home buyers have to push themselves to get on the property ladder, cost isn’t the only consideration when buying a first home,” said Soper. “While some young people are relocating to more affordable cities, those who stay value shorter commutes and access to the benefits of city life.”

Paying low rents to the ‘rents

One in four new homeowners had been living with their parents before buying their first home.

A similar share had been paying rent to their parents but 30% said the amount was below market rates.

As they were still at home, 17% said their parents had delayed downsizing and a further 15% said that wouldn’t happen until younger siblings leave the nest.

Regional findings

Sixty per cent of respondents in Ontario expressed anxiety about their down payment stretching enough to get the home they wanted, compared to 68 per cent of respondents in Toronto.

“Buying a property can be stressful for anyone, but for first-time home buyers, the anxiety is magnified by the unknowns,” said Caroline Baile, broker, Royal LePage Your Community Realty. “A good starting place is to define your wishlist and focus on your priorities.”

Shorter commutes were valued more than square footage in Toronto as 59 per cent of respondents in the region preferred a more expensive and smaller home located closer to where they or their spouse work – the highest regional percentage in Canada.

“There is a large portion of first-time home buyers in Toronto who will sacrifice size for location. Time is important – as are childcare, schools, and proximity to work,” said Baile. “Sometimes that means purchasing a condo in the city within walking distance of work, or even living with parents a little longer to position themselves better to get the home they want.”

Thirty per cent of respondents in Ontario and 34 per cent in Toronto lived with parents or other relatives before buying their first home, surpassing the national average (25%).

QUEBEC

Fifty-one per cent of respondents in Quebec (excluding Montreal) expressed anxiety about their down payment stretching enough to get the home they wanted, compared to 60 per cent of respondents in Montreal.

“While those who live in other parts of the province have the convenience of time and can shop around, we are seeing that first-time home buyers in Montreal are feeling the pressure to make quick decisions to enter the market,” said Dominic St-Pierre, vice president and general manager, Royal LePage, for the Quebec region. “Low inventory and high demand have encouraged an increase of multiple offers in the city in favour of more

experienced buyers. First-time home buyers have to be prepared and secure financing prior to making an offer, with a sufficient down payment and mortgage pre-approval if they are serious about a purchase.”

Nearly one quarter of Montrealers (23%) lived with family prior to buying their first home, compared to 16 per cent elsewhere in Quebec. Compared to the rest of the country, Quebec is the province with the most significant gap between the largest urban centre compared to the rest of the province when it comes to first-time buyers paying rent to their parents before purchasing their own home. Seventy-four per cent of respondents in Montreal said they did not pay rent to their family or relatives compared to only 53 per cent of Quebecers (outside Montreal).

BRITISH COLUMBIA

Fifty-six per cent of respondents in British Columbia expressed anxiety about their down payment stretching enough to get the home they wanted, compared to 58 per cent of respondents in Vancouver.

“Early generational wealth transfer from downsizing Baby Boomers has given a financial boost to first-time home buyers,” said Adil Dinani, real estate advisor, Royal LePage West. “Despite some softening in prices, first-time home buyers are optimistic about the long term health of the region’s real estate market.”

Twenty-seven per cent of respondents in British Columbia lived with family before buying a home. Fifty-eight per cent of those living at home paid rent to relatives, and of those paying rent, 45 per cent paid below market rates.

Of the respondents who lived at home before buying, 14 per cent said that living at home delayed their parents’ decision to downsize.

Forty-six per cent of respondents in B.C. chose to buy a more expensive, smaller home located close to where they/their spouse worked compared to 54 per cent of respondents in Vancouver.

“There will always be an attraction to buy in the city centre. In Greater Vancouver, there are newly-developed urban amenities and transportation infrastructure that increase the desirability of homes outside the core,” said Dinani. “These high density hubs create opportunities for people who are new to the market; they can embrace urban living with more space and connection to transit.”

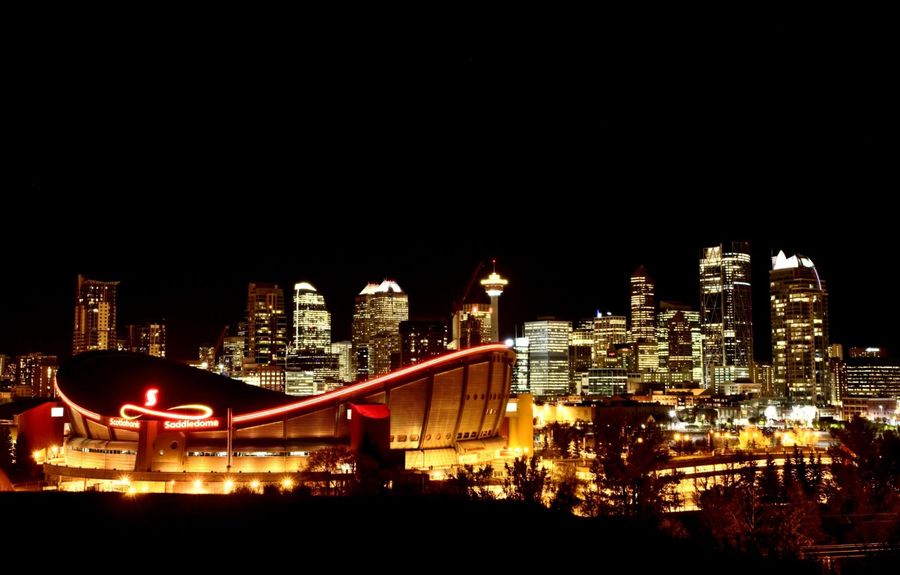

ALBERTA

Forty-nine percent of respondents in Calgary expressed anxiety about their down payment to get the home they wanted, compared to 62 per cent elsewhere in Alberta.

Among Calgarians living with family before buying a home, 47 per cent said their parents did not have plans to later downsize. Twenty per cent of respondents said staying in the home did delay their parents’ decision to downsize while 31 per cent indicated they had siblings who would need to move before parents could downsize.

“There’s definitely more opportunity in Calgary,” says Corinne Lyall, broker and owner, Royal LePage Benchmark. “You have a larger population of younger people who are very career-focused, with more buying ability. There are also a number of Baby Boomers who are in a position to help their millennial children purchase their first home.”

Forty-two per cent of those surveyed in Calgary said their home location represents a similar commute for both spouses/partners, representing the highest percentage compared to other regions. The national average is 36 per cent.

ATLANTIC CANADA

The Atlantic Canada region bucks the trend for anxiety in relation to their down payment. Fifty-four per cent of those surveyed said they were not worried about their down payment compared to 41 per cent nationally.

“Home prices are not outside the reach of younger Canadians in Atlantic Canada. We still see buyers getting help from ‘the bank of Mom and Dad’ but there’s fantastic affordability and opportunity here,” said Marc Doucet, broker of record, Royal LePage Atlantic.

Seventy-four per cent of those surveyed in Atlantic Canada rented before purchasing their first home. Twenty per cent of respondents in Atlantic Canada lived with family before buying a home; 54 per cent paid rent to relatives, while 17 per cent paid market rates. Among those respondents who lived at home before buying, 20 per cent reported their parents delayed plans to downsize until the respondents moved out of the family home.

PRAIRIES

Fifty-seven per cent of first-time home buyers in the Prairie provinces were worried about their ability to get the home they wanted with their down payment.

When it came to proximity to work, 39 per cent of respondents in Manitoba and Saskatchewan preferred a relatively more expensive, smaller home in exchange for a shorter commute.

“Where you live dictates how you live,” offered Michael Froese, broker and managing partner, Royal LePage Prime Real Estate. “A lot of first-time home buyers are looking at their purchase not just as a home, but as an investment as well. When it comes to resale value, choosing a good neighbourhood is part of the decision. You can always improve the house; you can’t change the location. Good advice for new home owners is to budget for some renovation and repairs.”

Among those living with family before buying a home, 71 per cent said their parents did not have plans to later downsize. Thirteen per cent of respondents said staying in the home did delay their parents’ decision to downsize while 7 per cent indicated they had siblings who would need to move before parents could downsize.

Thirty-six per cent of respondents in the Prairies paid rent to families at below market rates before purchasing their own home, slightly higher than the national average of 30 per cent.

Steve Randall has more than three decades of media experience encompassing online, newspapers, magazines, radio, and podcasts. He focuses on insights and news for professionals in finance, real estate, and legal services. Steve writes for multiple Key Media titles in Canada, United States, Australia, and New Zealand.