Last Updated on October 24, 2023 by CREW Editorial

One of the most common concerns people have about real estate investment is the risk of vacancy. In our practice, we have found that vacancy tends to be the number-one risk that concerns our investors.

This is understandable. After all, if there is no tenant, there is no cash flow. The trick is knowing how to reduce the risk of property vacancy to a level that allows you to sleep soundly at night while still remaining hands-off.

There are a number of ways to mitigate the risk of vacancy, including buying in a market that has a low vacancy rate, hiring a good property manager and joining a rental protection program. Let’s explore each strategy separately.

Look for properties in markets with lower vacancy rates

Many parts of Canada, especially urban areas, have historically low vacancy rates right now. With a tighter rental supply, it will be easier to find good tenants and keep them longer. Renters are more likely to stay put rather than risk a large rent increase on the open market.

In some cases, tenants in these markets might be less picky when it comes to building condition and maintenance, but you must still fulfil your duties as an owner. If being a full-time landlord isn’t for you, however …

Hire a reliable property manager

The dream is to invest in a property that your tenants will love so much that they’ll want to stay comfortably into the future. Life, though, goes on. When one of your tenants does eventually give notice, you will want to make sure someone is immediately on the case to find a new tenant before the month is out.

Having a property manager takes this pressure off you. After all, you have a life beyond real estate and your own personal responsibilities to take care of.

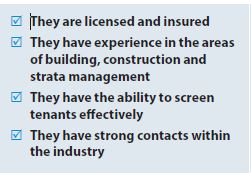

For this strategy to work effectively, you need to have the right person for the job. Therefore, your property manager should tick all of the following boxes:

Finding a good property manager or property management company pays off in innumerable ways: Not only can a property manager help you find and retain good tenants, but they can also fix any repairs that come up and serve as a point of contact for your tenants so you won’t be the one waking up at 2 a.m. to fix a flooded kitchen. A good property manager will keep undesirable tenants out while making sure things run smoothly so that quality tenants will want to stay.

Join a rental protection program

A rental protection program is a safe way to ensure that your cash flow continues even if a vacancy does occur at your property. Here’s how it works.

Let’s use a condo project with a total of 50 units as an example. Each of these units is individually owned by a different investor, but the same property management company manages every unit. The company sets up an optional rental protection program, which the owners of each unit can choose to join. The units in the program are grouped together and treated as one single entity.

Let’s say all 50 units join the program, and one property sits vacant for the month of January. Considering the program as a whole, 98% of the properties are occupied, so each unit is considered to be 98% occupied for January. Therefore, each investor receives 98% of their rental income, regardless of which unit is vacant. This is an effective strategy for ensuring the cash keeps flowing to you and the other owners in the program each month.

The added benefit of purchasing units in a building managed by one property manager is that the cost of management will be significantly lower. Instead of paying 10% to 12% of your monthly income for an independent property manager, you will only pay 3% to 5% for a manager that is taking care of the whole property.

Real estate investment is for the long term. Every investor will run into vacancies on their road to success, but vacancies need not be a deterrent to building a profitable portfolio of rental properties.

Platinum Properties Group works with clients to do a financial assessment from a bank’s perspective to see how they can fully utilize the power of leverage. With more than a century of experience in finance and real estate investing, we can help guide you through the confusing and sometimes intimidating world of bank financing to help you start building your real estate portfolio. To learn more about Platinum Properties Group’s proven real estate investment strategies, or to get started increasing your wealth through income properties, download our free guide at ppgcorp.ca/request-free-guide.