Last Updated on October 24, 2023 by CREW Editorial

For investors lacking one, a background in construction might seem like the ultimate missed opportunity. What other field provides you with skills that allow you to evaluate the guts of a property or greatly reduce the cost of extensive renovations? What better way to prepare yourself for your initial infill project or the inevitable repairs demanded by your first large-scale multi-unit property?

But those looking at construction from the outside are generally unaware – especially at a time when demand for new housing in Canada’s largest markets seems unquenchable – of the industry’s feast-or-famine nature. “Either you’re busy,” says Brian McGuckian, “or you’re dead.”

McGuckian followed his father into construction after completing high school. It wasn’t long before he learned just how painful those gaps between jobs could be. Maintaining a steady income was proving challenging in the family’s adopted hometown of Toronto – McGuckian and his parents immigrated to the city from England when he was 7 – so, after a four-year slog of hits and misses, he decided to venture back to London to ply his trade and create more stability for himself.

That stability wouldn’t come in the form of a steady paycheck, but rather in the form of McGuckian’s new bride, Maria, whom he met during a trip to Ibiza in 1983. Within a year of their wedding, the couple was back in Toronto. While Maria’s nursing background allowed her to find consistent work right away, Brian was faced with the same prospects as before. Over the course of the next decade, he started a number of other businesses to supplement his income – supplying labour to homebuilders, exporting Corvettes to the UK – but a deeper satisfaction remained elusive.

“I knew I was meant for better things,” he says. “I always knew there was something out there that, sooner or later, we’d be able to capitalize on. It was just a matter of: What is it?”

The answer to McGuckian’s question materialized late one night when a confident, undersized Vietnamese man sailed onto his television screen on a rented yacht. Surrounded by a bevy of bikini-clad models (also rented) who seemed completely indifferent to him, Tom Vu promised financial freedom through real estate. The general awfulness of Vu’s infomercials did nothing to blunt their overall message: If this guy can do it, so can you.

“But we could never find anything with a Canadian base to it,” McGuckian says. “It was never a Canadian home. It was the Americanized version, and I knew that wouldn’t really cut it.”

Hungry for a pursuit that would satisfy his unrelenting desire for something more – and for the less cartoonish aspects of Tom Vu’s success – McGuckian started educating himself about the power of cash flow and team-building. “That basically started the wheels in motion for me and my wife,” he says.

Inexperience as an asset

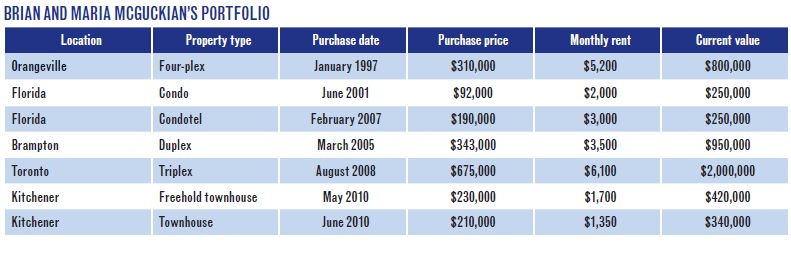

The McGuckians’ first purchase was an underperforming four-plex in Orangeville, Ontario. Even though Orangeville was barely a blip on investor radars 30 years ago, the initial price – $310,000 – was considerable at that time. But McGuckian says the property’s untapped potential outweighed the couple’s apprehensions and inexperience.

“I didn’t have a clue what a lease looked like,” he says. “I didn’t have a clue about any of that stuff. It was 100% fly by the seat of your pants.”

But rather than hold the couple back, their lack of knowledge gave the McGuckians free rein to experiment and find simple, innovative cures for a number of common landlord headaches, namely getting rid of problem tenants. “Instead of relying on the standard kangaroo court of the [Landlord and Tenant Board] tribunal in Ontario,” he says, “it was so much easier just to give them moving money.”

When it comes to ingratiating himself with new tenants, McGuckian says one of the best ways he has found is to bring them gifts upon moving in – and at Christmas, too.

“It really takes away a lot of the hassles of the day-to-day maintenance of properties,” he says, adding that doing so encourages tenants to take care of small issues themselves rather than annoying their generous and thoughtful landlord. “You’re investing in a customer who’s paying you anywhere between $12,000 and $20,000 a year.”

In more recent years, McGuckian has turned to the internet to find clever ways of determining what renters are willing to pay. He recently posted a series of dummy ads on Kijiji to find out what tenants would pay for a two-car garage in Toronto’s Little Italy neighbourhood. By increasing the amount posted in each ad by $100, McGuckian found that the magic number was $600. “And you wouldn’t believe what they put in it,” he laughs. “I don’t think the two cars are worth $600.”

Paradise calling

Rather than staying focused on a particular region, McGuckian expanded his portfolio to include properties in Brampton, Kitchener and Guelph. “It wasn’t the way they teach you,” he acknowledges.

Instead of focusing on a single area, McGuckian pulled the trigger on deals whenever they popped up in a top 10 Ontario market and there were joint-venture partners hungry for a smart purchase. “In the end it’s worked out, because everyone is very happy with the results we’ve been able to obtain using our system,” he says.

McGuckian abandoned Ontario altogether for two of his most profitable single-family properties. At a time when Canadian investors might be questioning further forays into the US market, McGuckian’s continued success in Florida speaks to the area’s enduring appeal.

While his first purchase – a one-bedroom waterfront condo in St. Petersburg nabbed for only $92,000 – was essentially a painless impulse buy, the second – a condo hotel unit in Treasure Island – was purchased for $200,000 in 2007, mere months before wildly irresponsible lending practices helped flip the world economy on its head, leaving Florida’s market severely concussed.

As the market continued its brutal, multi-year meltdown and McGuckian found himself pouring more money than he could afford into the unit, another manmade disaster – the Deepwater Horizon oil spill – hit Florida. Vacancies skyrocketed, as did McGuckian’s anxiety. If it weren’t for a $25,000 cheque from British Petroleum, holding onto the property would have soon become impossible.

Narrowly escaped catastrophes aside, McGuckian is still bullish on Florida real estate. Prices are fair, and Canada’s rapidly aging population virtually guarantees a steady stream of snowbirds as tenants; the two properties he owns net $25,000 a year in rent. He says investors worried about managing their properties from a distance have little to worry about – maintenance crews are the same phone call away, no matter where an owner lives – especially if they rent their units for a minimum of 30 days. “Typically, when people rent for 30 days, they’re going to treat the place like their home,” he says. “They’re not going to treat it like someone who’s spending three days in a hotel.”

When CREW spoke to McGuckian, he and his wife were a few weeks into their most recent Florida getaway, steeping themselves in sunshine and crunching the numbers for the possible purchase of their first largescale apartment building – rewards creating opportunities rather than the other way around. Whether he envisioned luxury or freedom when he went in search of better things, Brian McGuckian can now enjoy his share of both.