Last Updated on October 24, 2023 by CREW Editorial

Many CREW readers will be familiar with the basic taxation differences that exist between corporations and individuals. But there’s a plethora of planning techniques that can be beneficial for real estate investors. Using a theoretical investor as an example, let’s explore four ideas you can use to ensure you’re keeping as much money in your bank account as possible.

Tony Shark is an active real estate investor and a sole shareholder of Shark Industries (‘OpCo’). OpCo is involved in real estate activities such as construction management and property management services. Tony holds his investment properties via various Ontario numbered companies (collectively ‘HoldCo’). OpCo provides services to both HoldCo and external clients. For the purposes of this illustration, we will assume that OpCo is eligible for the small business tax rate. Tony has a daughter, Morgan, who is currently a minor. Tony’s plan is to pass on OpCo to Morgan when he retires. The following are a few of the corporate tax strategies Tony has at his disposal.

1. Timing play

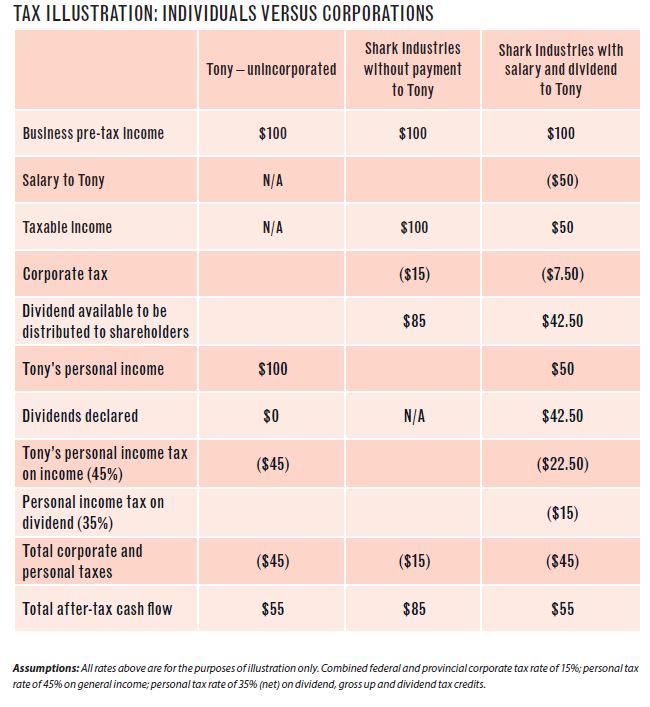

Tax deferral is always a key planning area between corporations and shareholders. As many of us are aware, there is a huge gap between the small business corporate tax rate and individual tax rates. As illustrated in the second column of the chart on the opposite page, the amount not paid out to Tony can help grow Shark Industries. A $100 revenue can leave OpCo with $85 to reinvest into its business, compared to only $55 if Tony was not incorporated.

The compounding effect of reinvestment can be astonishing. Looking at it with the mindset of an entrepreneur, the compounding effect would help OpCo achieve a higher profit sooner.

2. Payment game

Since Tony is the sole shareholder of OpCo, he can dictate the timing, amount and form of payments from Shark Industries to himself. One of the common techniques to achieve tax deferral is the declaration of a bonus payment from OpCo to Tony.

Generally, tax treatment for corporation expenses is based on financial statements prepared in accordance with accounting rules, while most of the taxable income for personal tax is accounted for on a cash basis. If OpCo has a taxation year-end of August 31, 2019, accruing a bonus payable to Tony would allow a deduction for corporate tax, assuming the accrued bonus is paid within 180 days after the company’s year-end.

On the flip side, if the accrued bonus was paid to Tony in January 2020, such an amount would not be included in his personal income until 2020. You should also look into the withholding tax requirement on such payments. If Tony directs the amount from his bonus payout into a registered savings plan (RSP or RRSP), such a payment is typically not subject to income tax payroll withholding.

3. Estate planning

Life insurance proceeds in Canada are generally tax-free to the beneficiaries. Tony can achieve permanent savings by purchasing life insurance policies through OpCo. Tony would be the insured, and OpCo would be the beneficiary. However, there is one catch to obtaining insurance proceeds: Tony, unfortunately, has to die.

If Tony passes away, the life insurance proceeds will be paid to OpCo, and the proceeds can be paid out to shareholders of OpCo on a tax-free basis. If proper planning was implemented prior to Tony’s death, Morgan would have been made a shareholder of OpCo. This would allow Morgan to get access to the insurance proceeds much faster than through the typical estate process.

If Tony were to purchase the policy personally, for every $100 in income he made, he would only be left with $55 to purchase life insurance; with the corporation structure, he would have $85 to purchase insurance policies. This allows Tony to get a policy with larger proceeds, even with the same amount of pre-tax income.

This technique is often used in planning for high-net-worth intergenerational wealth management. Such a structure might also make use of a holding company that owns shares of the operating company.

Recent changes to taxes on income generated from certain types of life insurance policies might have an impact on this strategy. You should speak to your insurance and tax advisors if you plan to implement this strategy.

4. Capital gains exemption

Generally, the sale of qualified small business corporation shares is exempt from income tax for shareholders. Currently, the lifetime capital gains exemption limit for 2019 is $866,912. That limit will increase based on the inflation rate.

Let’s assume Tony’s OpCo is making a profit of $150,000 a year, and a potential buyer is willing to purchase Tony’s OpCo shares at an earning multiple of five times ($750,000). Tony will be taking home $750,000 tax-free, assuming the sale has met all the conditions. As we all know, there aren’t that many tax-free opportunities around – so make use of this one!

The above examples are just the tip of the iceberg as to what an investor can do to minimize taxes for their real estate business. As always, consult with a tax professional to ensure your tax strategies are optimized for the long run.

Andrew Ku is a licensed public accountant who lives and works in Toronto. Contact him at andrew.ku@ realestatetaxes.ca.