Last Updated on October 24, 2023 by CREW Editorial

As a wealth strategist, the number one question I get from people approaching retirement is, “How much money do I need to retire?” It’s a discussion that often doesn’t arise early enough in the financial planning process. Real estate is a proven strategy to grow wealth, but you still might be unpleasantly surprised at how little income it will provide in your golden years.

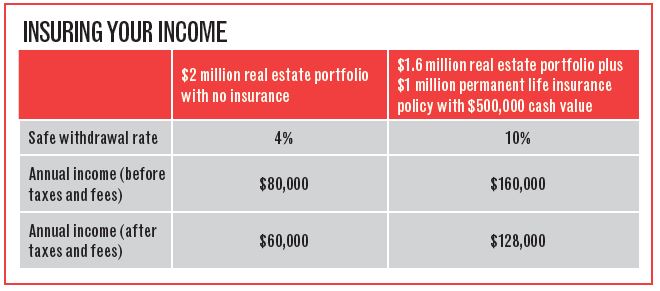

Google ‘safe withdrawal rate,’ and you’ll see research indicating that you shouldn’t be withdrawing more than 3% or 4% of your assets in any given year in retirement. It’s shocking how little income this is. If you have $2 million at age 65, you can safely only withdraw $80,000 a year to live on. And even then, there is only a 90% chance that you will not outlive your money. It’s safe to say that taxation and fees can easily eat up an additional 25% of that income, leaving you with only $60,000 a year.

While you might have much of your wealth in real estate now, in retirement you’ll want to have a more conservative approach. The problem is that fixed-income yields are low and equity can be volatile, waiting for a depressed real estate market to rebound might not be an option if you need the funds to live on, and you might not feel as comfortable with the same level of debt you currently have once you’re in your 70s. Not to mention, managing rental properties in your golden years might not be the retirement you envisioned.

There is a way, however, to generate greater income in retirement. In addition to building up an income property portfolio, I always recommend clients invest in permanent cash value insurance as well.

What is permanent cash value insurance?

Permanent cash value insurance is a life insurance policy that has not only a death benefit, but also an accumulation account within the policy. Each time you make a premium deposit, part of the money goes toward the cost of insurance, and part goes into this separate account. Because the funds grow tax-free within a policy and can be accessed tax-free via a policy loan or bank collateralization of the policy, you can get tremendous value from the policy during your lifetime.

Both the death benefit and the cash value can grow over time, with the cash value equalizing the death benefit, typically at age 100. The cash value is there in retirement to protect you against unforeseen situations, but it can also be accessed in the early years for investment purposes and can be a great tool for businesspeople and real estate investors.

With this strategy, you can have your cake and eat it, too. You can access the investment you make in the insurance plan to help you acquire more properties down the road, similar to the strategy of refinancing your principal residence and pulling out money for the deposit on your first investment property. You can use the cash value for the down payment on future property purchases or to pay down mortgages so properties have greater cash flow.

It’s a mistake to think that once you’re no longer working, you don’t need life insurance. In retirement, insurance protects the assets that are providing your income. A retiree with permanent cash value insurance can safely access a much greater income from their wealth than a retiree without it.

Many real estate investors are reluctant to invest in this approach because they’re focused on building their real estate portfolio. But using this wealth strategy won’t impede the growth of your real estate wealth. In fact, it can enhance it. The funds you invest grow, tax-sheltered, and can be accessed via a loan to purchase more properties.

What could go wrong?

You will likely be retired for 20 to 30 years, and it won’t all be smooth sailing. Permanent cash value insurance can help you deal with the following complications:

1.Death.

How will your family continue to build a real estate portfolio and provide for your children’s education if they aren’t able to qualify for mortgages? Permanent cash value insurance will help them continue saving without your income.

2.Depressed real estate market.

Right now, your plan might be to sell off a property for income in retirement. But what happens if real estate markets have a major pullback and the income you expect your portfolio to provide is much less than expected? You can rely on the cash value in your policy for income while the real estate market recovers.

3.Extended vacancy or a non-paying tenant.

If you run into an extended vacancy or a problem tenant who isn’t paying rent – the income you need to live on – you can go to the cash value in your policy instead of being forced to sell some other asset.

When you have permanent cash value insurance with guarantees, you already have a huge proportion of your wealth in one of the most conservative assets around. As a result, you can have a greater proportion of your other wealth in less conservative assets like income properties or equities. You don’t need to lock up money in bonds with poor yields. Because you have permanent cash value insurance, you can weather the volatility of more aggressive assets.

KATHLEEN VAN DEN BERG is a financial planner and mortgage agent in Ontario’s Durham Region. For more information, visit kavwealthstrategies.com.

KATHLEEN VAN DEN BERG is a financial planner and mortgage agent in Ontario’s Durham Region. For more information, visit kavwealthstrategies.com.