Last Updated on October 24, 2023 by Neil Sharma

Canadians’ appetite for recreational properties has grown during the COVID-19 pandemic as many have taken advantage of remote working capabilities to flee for greener pastures.

In fact, a new survey from RE/MAX conducted in partnership with Leger determined that 57% of markets offered recreational properties for below $500,000, but the average price, it is believed, will rise by 30% in certain markets. Moreover, 44% of recreational property purchasers have set aside $200,000-500,000 they plan to use in the next year.

Fifty-nine percent of survey respondents who intend to buy a cottage property in the next year are first-time buyers, while 21% are looking to buy recreational properties because they’ve been priced out of an urban centre. Twenty-two percent of respondents stated that they are taking advantage of low interest rates to facilitate their planned purchase, while 11% were seeking a recreational property before the pandemic began, and 15% weren’t searching prior to March 2020 but are now.

“There’s intense competition among buyers in Canada’s recreational property markets and inventory is stretched thin,” said Christopher Alexander, chief strategy officer and executive vice president of RE/MAX Ontario-Atlantic Canada. “But Canadians recognize that recreational properties remain an affordable option in such a turbulent market. There are still many recreational markets across Canada that are deemed affordable, despite the growing demand and rising prices.”

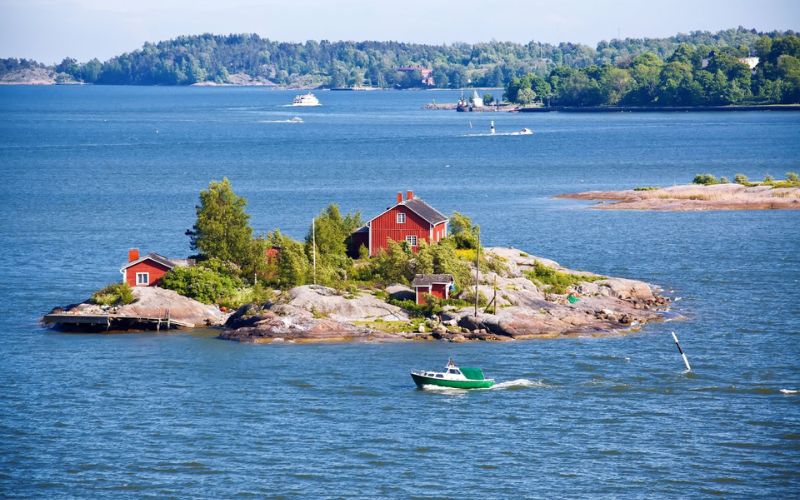

The most affordable regions in Canada for waterfront properties include Thunder Bay ($425,805), Charlottetown ($334,447), and the Interlake Region of Manitoba ($363,833), while the most expensive are the Okanagan ($2,430,434), Barrie-Innisfil ($1,841,217), and the Niagara region ($1,546,561).

Commenting on the Okanagan’s exorbitant price points, Jon Friesen, CEO of Kelowna-based developer Mission Group, estimates that 60-70% of recent buyers in the area are from the Lower Mainland of Vancouver, many of whom are already planning for their retirement. However, the more obvious reason, added Friesen, is the dearth of waterfront properties.

“Waterfront properties are becoming more scarce and people are thinking, ‘We better get in while we can,’” he said. “We’re seeing a huge number of newcomers. Most of Kelowna is close to the water and it’s not proximity they’re interested in, they want to be on the water.”

The price of an Okanagan waterfront property averages over $2 million and Friesen says it’s not uncommon for properties to trade for $3-5 million. Nevertheless, the region is following a nationwide trend.

“It’s a trend we’ve seen all across Canada, with people trying to move out of densified urban cores to somewhere more relaxed. Kelowna checks those boxes and it’s still half the price of Vancouver, so why wouldn’t you?”

Neil Sharma is the Editor-In-Chief of Canadian Real Estate Wealth and Real Estate Professional. As a journalist, he has covered Canada’s housing market for the Toronto Star, Toronto Sun, National Post, and other publications, specializing in everything from market trends to mortgage and investment advice. He can be reached at neil@crewmedia.ca.