Last Updated on October 24, 2023 by Corben Grant

The first time you bought something as a child and had to pay an unexpected sales tax, you probably quickly learned that prices are not always what they seem. Many adults run into the same problem when they decide to sign onto a mortgage and are faced with their mortgage interest rate. Mortgages cost hundreds of thousands of dollars and by comparison, interest rates seem so minuscule.

Consider, however, that interest is the primary money-maker for banks, so perhaps that minuscule figure is not so small after all. Indeed, over the many years of a mortgage, you will end up paying far more than the listed sale price of your home in mortgage interest, gradually paid along with the principal in your mortgage payments.

One thing most people don’t learn as children is mortgage interest calculations. Most people have to learn the somewhat complex math behind the interest in a short time before signing their mortgage or choose to never learn it at all and trust their lender to do the math.

In reality, you don’t need to know the complete mathematics of interest calculations, but it is helpful to understand exactly how interest payments work and how they’re calculated, especially before you sign on to a decades-long mortgage.

In this article, we will cover for you the basics of where your mortgage interest rate comes from, and how that interest rate affects how much you pay.

What is mortgage interest?

Mortgage interest is the amount you pay to the bank in return for getting to borrow their money for a period of time. When you pay your , you not only pay for the price of your home but also for the mortgage interest that your bank charges based on an interest rate set by the bank and agreed to before the start of the mortgage term. Your mortgage interest rate can change at the end of your mortgage term, at the soonest, or even more often for a variable-rate mortgage.

How do banks decide interest rates?

So, you shopped around your mortgage and found that many of the lenders you looked at offered a similar interest rate. You wonder: if the banks make up their interest rates, why don’t they just give me a lower rate? In theory, they could. Banks are such huge institutions that a single mortgage at a low rate probably wouldn’t hurt them very much.

However, if you got a low rate, everyone else would expect one too. The banks manage hundreds of thousands of mortgages and they need to accommodate for the average risk of all of those thousands of mortgages. Therefore, your rate must be a certain amount.

There are also other factors beyond risk assessment that help a bank decide where to set interest rates. First of all, banks themselves pay interest rates. One rate, the bank of Canada prime rate, is the rate that banks and the government charge when lending between each other, which surprisingly happens almost every day! Your bank would simply lose money if they offered rates below the rate at which they pay for their borrowed money.

Beyond that, banks are businesses meaning they have to keep up their operating costs, pay their employees, pay for their properties, and more. Not to mention, they want to keep their profits up. The CEOs have got to get their $10 million dollar salaries somehow!

How is my rate determined?

Your mortgage lender will offer you a rate based on a number of factors. In general, they will take into consideration things such as:

- The value of the property you are buying

- The amount of your down payment

- Your income and

- The term of the loan and the amortization period

- Whether or not your mortgage is fixed or variable rate.

Everyone’s particular deal they reach with their lender will be different. You can help yourself get a more favourable rate by saving a , having a higher credit score, taking on a variable rate, and more. Regardless, your bank will not offer you a mortgage you are unable to realistically pay, but how easily and how quickly you can pay it back will vary.

How is mortgage interest compounded?: Canada

Compounding is where the calculation of your mortgage payments can get complicated. Most mortgages in Canada are compounding, but the type of compounding can vary. For fixed-rate mortgages, Canadian law dictates that they compound semi-annually.

Compounding essentially means that your mortgage interest rate is divided over a number of periods and interest is paid on the value remaining from the previous period, which includes the principal plus interest. For example, a mortgage of 5% compounded semi-annually is better understood as a 2.5% interest twice a year. Due to compounding, the actual interest rate, or the effective rate, is closer to 5.06%, higher than your quoted 5%. The shorter your compounding period, the higher your effective interest rate will be, and compounded interest will make up a larger amount of your monthly payment.

This gets even more complicated as you are probably paying down your mortgage in monthly mortgage payments, meaning the values used for interest calculations are changing all the time. With a fixed payment amount, you will also be paying a different ratio of principal and interest for each of your mortgage payments.

Fixed-rate mortgages vs. variable-rate mortgages

There are two major types of mortgages available from lenders. The first is a fixed-rate mortgage. In a fixed-rate mortgage, you agree to a set mortgage interest rate at the beginning of your mortgage term and keep that rate through the term. Fixed-rate mortgages are always compounded semi-annually.

Because a fixed-rate mortgage is locked in, the bank takes on some risk by betting against any significant changes in rates during the term of your mortgage. Because of this, banks will usually charge a larger mortgage interest rate on fixed-rate mortgages. In return, the borrower gets the consistency and peace of mind of a set rate.

The other option is variable-rate mortgages. A variable rate mortgage starts with one rate, but the rate is subject to change as the bank’s variable rate adjusts to market conditions. This means that this loan is riskier for the borrower , but they also often have much lower rates than fixed mortgages. However, unlike fixed mortgages, variable-rate mortgages are not required to be compounded semiannually, this means you can end up paying a higher interest rate than it may seem at first, for example, if your loan is compounded monthly.

Mortgage Principal

Mortgage principal is the amount of the loan that you still have to make mortgage payments towards. Lenders can only charge interest on the money you actually owe them so your interest payment should gradually decrease as you pay down your mortgage.

This means you will pay by far the most interest in the earlier years of your mortgage, and less in the later years. This is also why making a larger down payment can help you save on your mortgage. The more you put down initially, the less principal you have to pay interest on.

How much will interest cost me?

If you are looking to finance a home, or are budgeting to buy a home, it is helpful to know the actual cost of your home after interest. By calculating this amount you can know the actual cost of your mortgage, and how much additional money you will be paying in mortgage interest payments. It is not uncommon for your cost at the end of your mortgage to be 20 – 30% higher than your home’s sale price.

Calculating monthly payments

To calculate the interest payment for one of your monthly payments, you need to start with your principal and your interest rate as a monthly figure. Your monthly rate is not the same as your interest rate, but rather is the interest rate divided by the payment period.

For example, if your mortgage has a 5% yearly interest rate and you pay monthly you need to divide that rate by 12. Your monthly interest rate will be about 0.41%. Multiplying the principal by this amount will give you the monthly interest. Adding that interest amount to the principal and subtracting your monthly payment amount will give you the starting monthly principal for next month’s interest calculation.

For a variable rate, you will need to determine your current mortgage rate before following the above calculations. These can change often, so make sure you are using the most recent number for your calculations.

Calculating interest across all mortgage payments

Calculating the total value of interest paid over your loan can be complicated, especially as interest rates may change between mortgage terms and the ratio between interest and principal payments shifts over the life of your mortgage. Generally, your lender will be doing all this math for you, and they are very competent when it comes to these calculations. If you notice anything out of place, however, it can be worthwhile to ask your lender about their calculations.

For the average person, it is recommended to use one of many mortgage or interest calculators on the internet. These automated tools allow you to enter your mortgage information and receive accurate results immediately. This will save you from any potential mistakes you would have made if you did the math yourself, as well as save you the headache of having to go through the whole process.

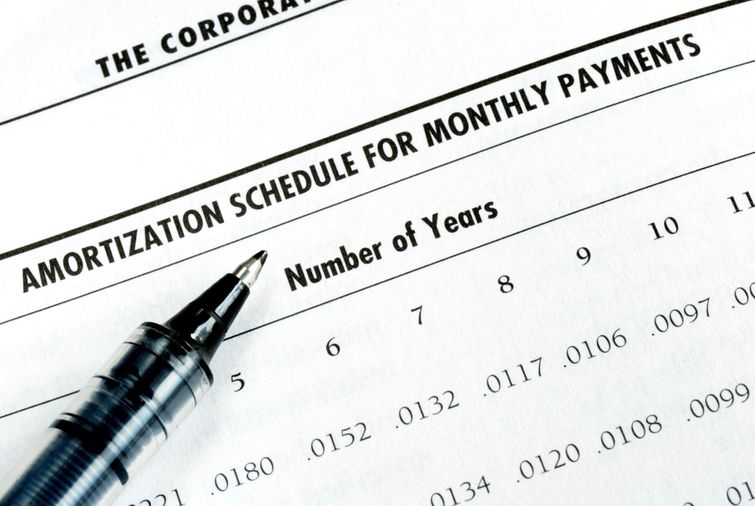

For a more detailed view, you can also prepare an amortization schedule, or find a tool that will put it together for you. An amortization schedule is a way of displaying the information on mortgage payments through the life of the mortgage. It can show you how much your loan principal will be at a given time, as well as how much of each payment goes towards principal vs interest.

How amortization period affects interest

Your amortization period is the set amount of time in which your lender has determined you will pay off your loan, and the basis for your monthly payment amounts. The lender also uses your amortization period to determine how much money they will be making from you in interest, which is why some mortgages will charge penalties for early repayment.

Basically, the longer you owe money, the longer interest has to accumulate. The shorter the amortization period, the less interest paid, but also the higher your regular payment price. You should aim for the shortest period you can afford the payments for. The most common amortization period for loans in Canada is 25 years.

It is possible to alter your amortization period, but if you choose to make it longer you will be trading smaller payment amounts for a higher total interest paid down the line.

Conclusion

The math behind your mortgage rate may seem complicated, but it is key to understanding if you are getting a good deal on your mortgage loan. A mortgage loan is determined by many dependent variables that all must work together. Though your mortgage rate is only one of these components, it can not be taken for granted, as there can be huge savings, or huge costs, that depend on it.

Corben joined CREW as a relative newcomer to the field of real estate and has since immersed himself and learned from the experts about everything there is to know on the topic. As a writer with CREW, Corben produces informative guides that answer the questions you need to know and reports on real estate and investment news developments across Canada. Corben lives in Guelph, Ontario with his partner and their two cats. Outside of work, he loves to cook, play music, and work on all kinds of creative projects. You can contact Corben at corben@crewmedia.ca or find him on Linkedin at https://www.linkedin.com/in/corbengrant/.