Last Updated on October 24, 2023 by Neil Sharma

If there is a housing bubble in Canada, it’s probably not where you think.

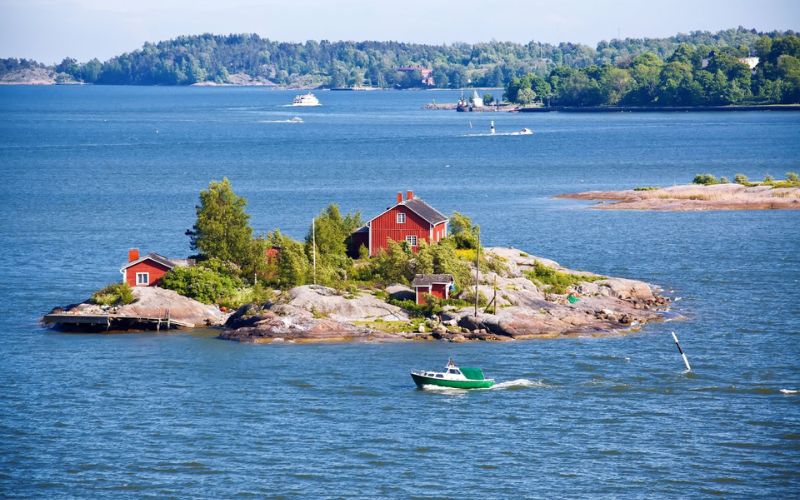

In the wake of the COVID-19 pandemic, Torontonians fled the dense urban core for arcadia and in droves with the intention of living in them year-round. However, according to Bradley Watson, a broker with Sutton Group – Summit Realty Inc. in Toronto, the cottage segment of the housing market is niche in nature and does not usually experience such a rush of demand as it has in the last year, which indicates an aberration occurred.

“If a price drop could happen by 20% in the housing market, it would be in the cottage segment,” Watson told CREW. “If there’s a point of concern in our market, it would be cottages. Demand has been so high because people have the expectation that there’s no need to return to Toronto when the pandemic is over.”

Part of the problem is prospective buyers, both cottage country locals and Torontonians, are bidding blindly on cottages and driving prices skyward. But unlike more common housing segments, like condominiums and detached houses, there isn’t a wide swath of buyers for them to begin with, save for the recent surge that’s divorced from market fundamentals. In fact, demand could become depleted in the very near future.

“A lot of demand that would have been in cottage country throughout the next five years has been pushed forward into 2020 and 2021, and the spring market frontloaded,” said Watson. “The demand that exists for cottages is not going to hold long-term, so you can expect a bit of a lull. The demand they’ve experienced in the last three to four months will not continue.

“There was such a high level of demand for such a short period of time. In the next year or two, in my mind, you will not see the same level of out-migration from Toronto to Muskoka. For those people who were involved in multiple offers and paid way too much, the demand will evaporate with no race upwards, so you may see people get caught because they purchased at a level that the market says is too high.”

Watson is sure that a chunk of the cohort who left Toronto will return because the city offers things that few other places in Canada can. And as several of his clients have told him, assuming maintenance of one’s own property is especially rankling and time consuming after years spent living in condos.

“These decisions aren’t yet being made because of reversals of work-from-home policies. The people who left early really miss living downtown, they miss living in a lively city, and on the other side, some people are tired of maintaining larger properties themselves.”

Neil Sharma is the Editor-In-Chief of Canadian Real Estate Wealth and Real Estate Professional. As a journalist, he has covered Canada’s housing market for the Toronto Star, Toronto Sun, National Post, and other publications, specializing in everything from market trends to mortgage and investment advice. He can be reached at neil@crewmedia.ca.