Last Updated on April 17, 2024 by CREW Editorial

On March 21, 2024, Immigration, Refugees and Citizenship Canada made an announcement regarding temporary residents. While recognizing the contribution to Canada that immigration provides, a key point of the announcement is that a target has been set to decrease the temporary resident population to 5% of the total population over the next three years. The aim is to manage and balance immigration sustainably, aligning it with labour market needs, and ensuring integrity in the system.

The announcement notes that employment is 1.2 million jobs above the pre-COVID February 2020 level. As of February 2024, the unemployment rate is at 5.8%, and the jobs lost during COVID are more than recovered, sitting at 138% of the COVID numbers.

As noted in a March 2024 Edge Realty report, this is likely to have a strong impact on the condo markets, as well as various other factors.

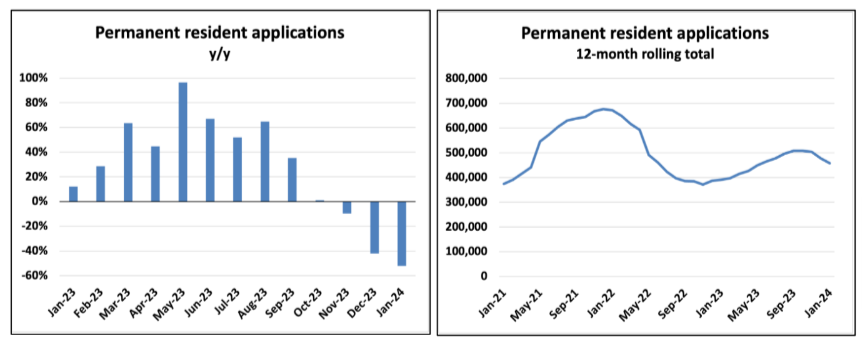

In January, the number of permanent resident applications dropped by over 50% year-over-year, continuing the trend of steep declines that have been seen in recent months. The Edge Realty report suggests that the Canadian cost of living and housing affordability crisis, which has been getting international coverage, may be making Canada less desirable to potential visitors and temporary residents.

Source: Edge Realty

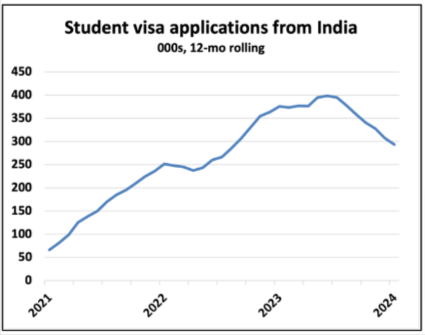

In January, there was a 42% year-over-year decrease in student visa applications from India. Over the preceding six months, admissions declined by 44% compared to the corresponding period in the previous year. While the diplomatic issues situation from 2023 will have played a role in this drop, recent international coverage about Canadian post-secondary institutions becoming “diploma mills” and providing poor experiences for international students has aggravated the situation.

Source: Edge Realty

The issue of limited supply remains a significant factor to consider. If the Canadian government initiates a relatively steady decline in non-permanent residents, the Edge Realty report predicts an annual population growth of roughly 300,000 a year from now. While this represents a notable decrease from the current 1.2 million, it is not significantly different from the average annual growth rate observed between 2010 and 2016. During that period, excess supply was not very abundant either.

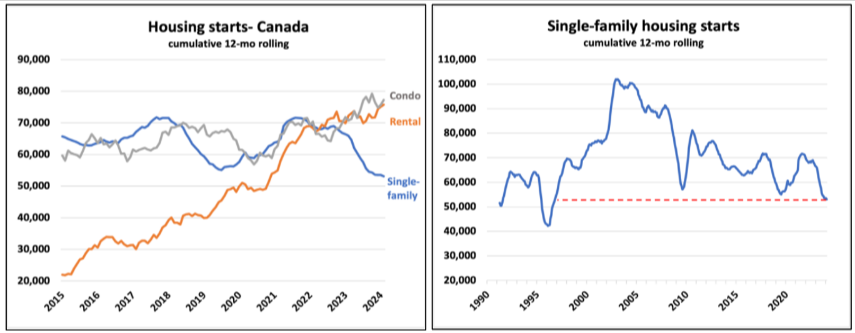

This adjustment is likely to reduce some pressure on the rental market, lowering annual increases from approximately 10% at turnover to around 2% to 3%. While it may slightly dampen demand for condos, particularly among investors, its impact on the single-family market is expected to be minimal. Recent housing starts data indicates that single-family starts have declined to levels last seen in the 1990s and are predicted to drop further based on permit data.

Source: Edge Realty

The multi-family segment has been keeping housing starts relatively high.

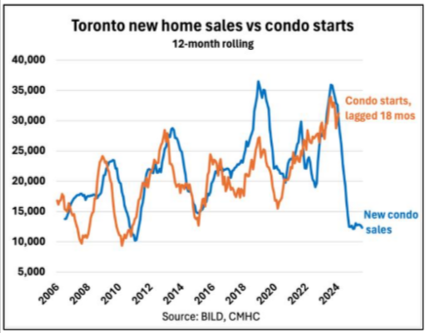

The report further predicts that given these market factors, condo starts are likely to fall significantly. Furthermore, since new condo sales precede condo starts in Toronto by 18 months, since developers must pre-sell units before getting financing to build, current statistics tend to support this trend. New condo sales fell 50% year-over-year in February, while the 12-month total dropped significantly to 12,000.

Although this is a setback for construction employment, it also indicates that once the surplus of condos over the next year or two, there will be limited new supply again afterward, as this is not a case of structural oversupply. Even if population growth slows as anticipated, the single-family housing market will remain tight for several years. While the multi-family segment may experience a cooling effect, there is no significant oversupply issue. Furthermore, a return to normal rental rates would likely be a positive development in the market.