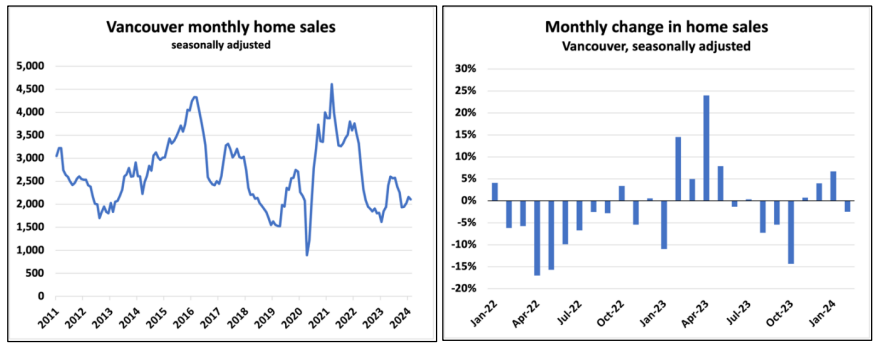

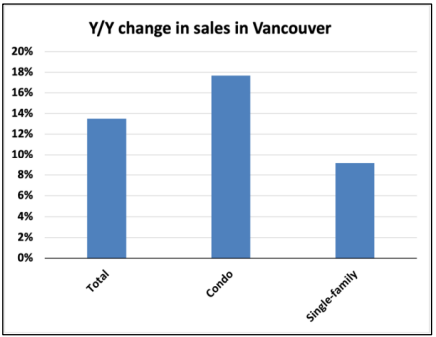

Despite a strong start to the year, according to an Edge Realty Analytics report1, Vancouver’s housing market experienced a slight setback in February, with seasonally adjusted home sales declining by an estimated 2% compared to January. Despite this drop, February sales were still higher when compared to the same period last year, with an increase of nearly 14%.

Sales

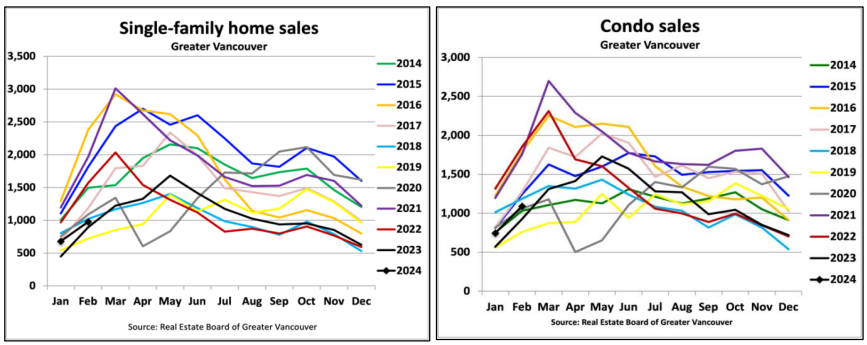

Both single-family and condominium sales have seen significant improvements from the levels observed in 2023, but they still fall below what is considered normal for the market.

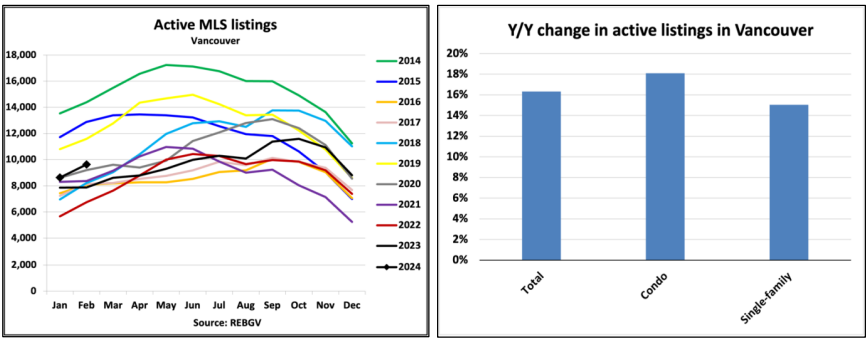

Listings

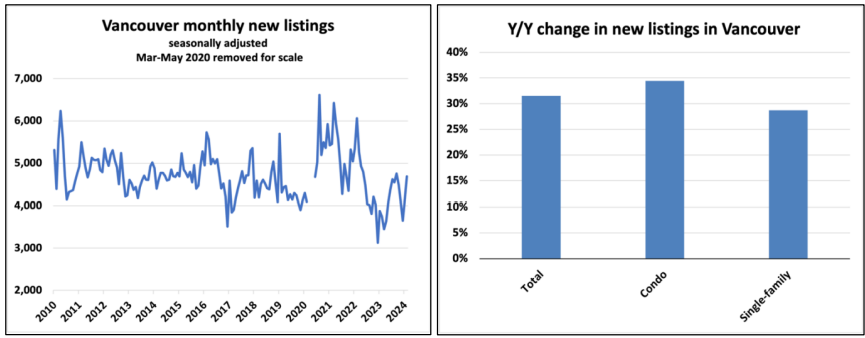

The trend of new listings surged once more, following a 15% increase in January, with a further seasonally-adjusted 12% rise recorded in February. This rise was also a significant 32% increase compared to the same period last year.

In February, Vancouver’s housing market experienced a shift in balance, with declining sales and increasing new listings. This resulted in a softened market condition, indicating a more favourable environment for buyers. The sales-to-new listings ratio fell to 45%, its lowest level since October.

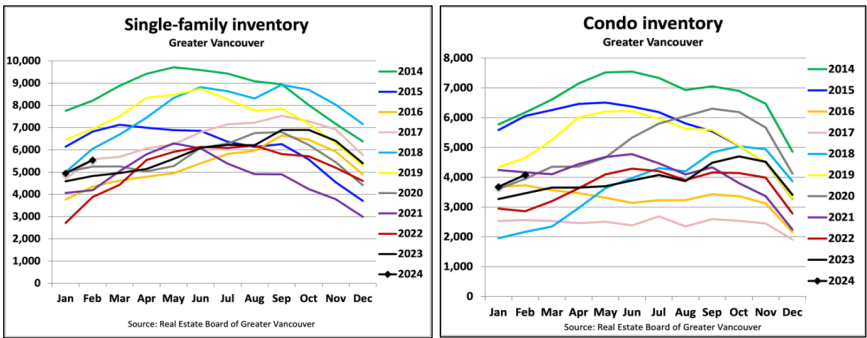

Inventory

Inventory also saw an increase, rising by 16% compared to last February, with a notable 18% increase observed in the condo segment. Despite the sluggish sales, inventory levels remain within the normal range for this time of year.

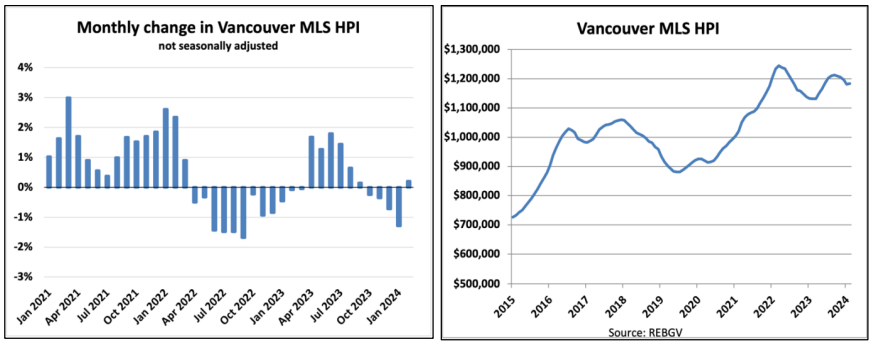

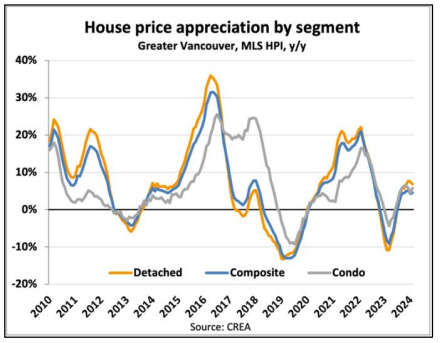

Pricing

Vancouver saw the end of a four-month trend of declining prices in February, with the MLS Home Price Index (HPI) registering a 0.2% month-on-month increase. Compared to the previous year, prices have risen by 4.6% overall and by 6.5% in the single-family segment.

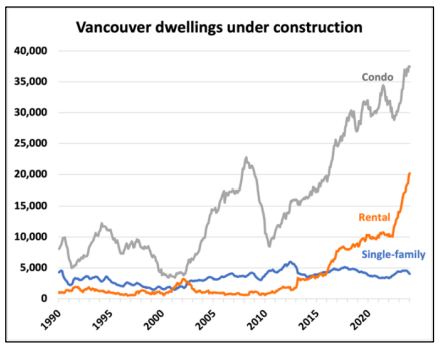

Construction

However, there’s concerning news regarding single-family construction activity, which experienced a significant decline. While the overall number of dwellings being built across Vancouver saw a marginal increase of 0.3% in January, this was solely due to a 1.7% rise in rental construction. In contrast, the construction of single-family homes dropped by another 2.3% and has plummeted by 12% over the past five months.

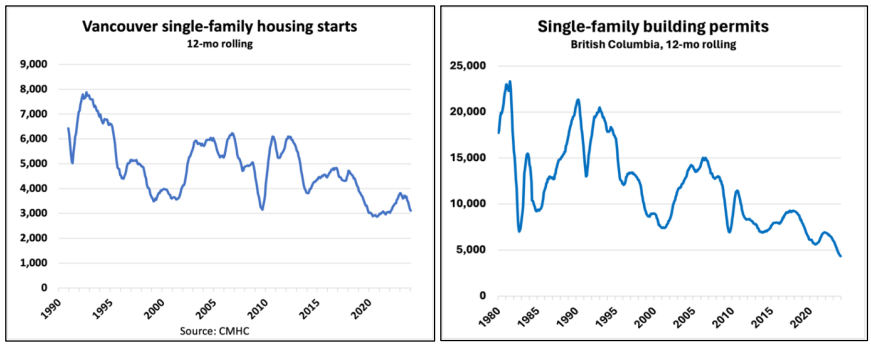

Similar to the situation in Toronto, metro Vancouver is witnessing a steep decline in single-family housing starts, with levels nearing those seen in 2020. This downward trend is likely to continue, given the trends in permits across BC. This shortage in new supply raises concerns about long-term housing availability.

Overall, while buyers may benefit from potentially lower prices in the short term due to current market trends, high interest rates and affordability issues, the scarcity of single-family housing supply in the coming years will likely create a bottom line. While buyers may find temporary advantages from lower prices, the overall supply shortage suggests other, long-term implications of this trend, such as the potential stability and value retention over time.