Last Updated on February 27, 2024 by CREW Editorial

The housing market in the Greater Toronto Area experienced a boost in activity in January 2024, with increases in sales, tight supply levels, nuanced price trends, and shifting market conditions.

Sales

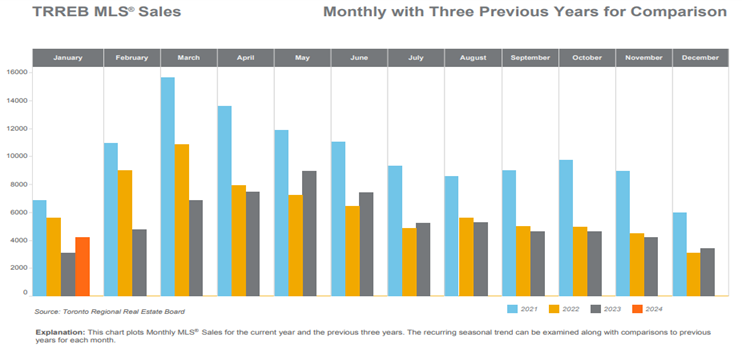

In January, total GTA MLS sales surged by 37% annually, reaching 4,223 transactions. Despite this increase, sales remained 9% below the 10-year average. The Toronto Regional Real Estate Board is projecting 77,000 sales for 2024, rising slightly, but remaining below ten-year averages.

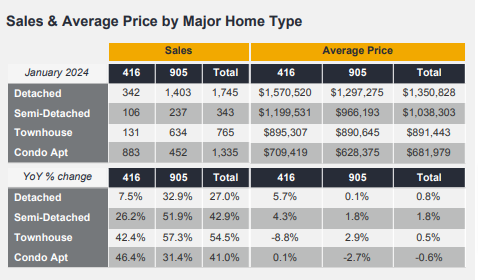

Market conditions shifted significantly for semis, rows, and townhomes, with sales rising by 51% annually, while detached homes saw only a 27% increase in sales.

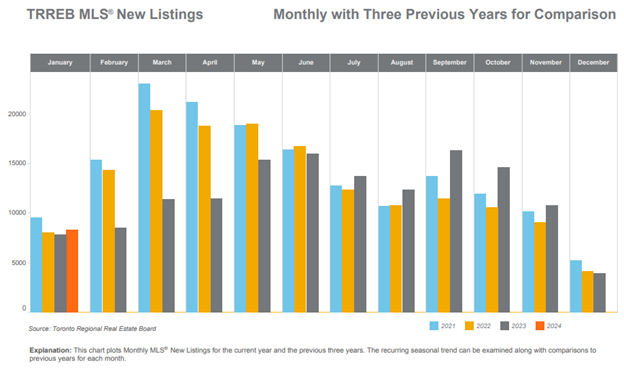

Supply

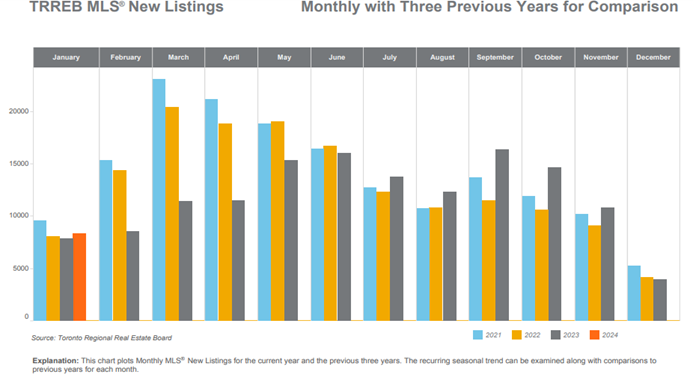

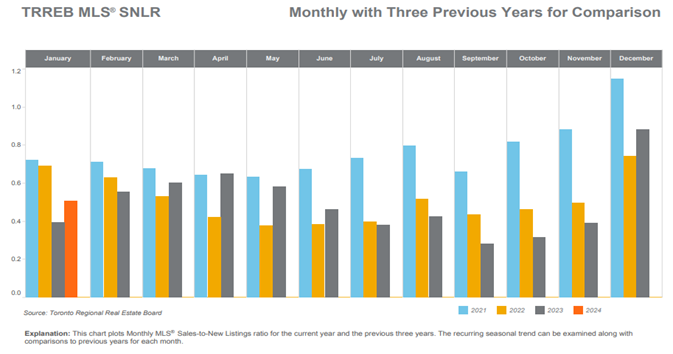

Active listings overall increased by 8% annually to 10,093 homes; however, inventory levels decreased further this January, dropping to 2.4 months. New listings rose by 6% year-over-year, leading to more balanced market conditions compared to the previous year.

Condominium listings grew the most, with new listings rising by 17% and active listings rising 25% over last year, but sales outpaced listings, leading to a decrease overall in inventory. Condo sales rose 41% year-over-year in January, so inventory fell to 3.5 months of supply, despite the increase in supply. Condos still have the largest supply of housing types. The increase in detached home sales, coupled with a drop in active listings pushed the inventory for these properties to 2.1 months.

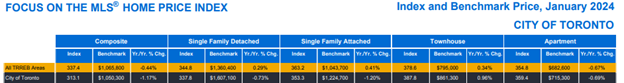

Price Trends

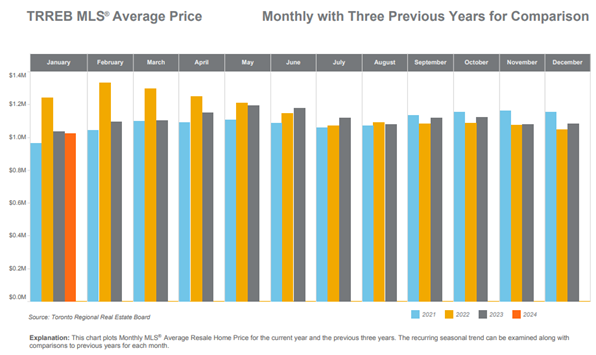

Average resale prices hit a three-year low of $1,026,703, reflecting a 1.0% annual decrease. However, this decline may be due to a shift to less expensive homes.

Average prices slightly increased for detached homes and semis, rows, and townhomes, and decreased slightly for condominium apartments.

Popular Price Points

The strongest sales growth for low-rise homes occurred within the $700K to $1.49M price range, especially within the $800,000 to 899,000 and $1.25 to 1.49M ranges. Condo apartment sales activity also surged in those $800,000 to 899,000 and $1.25 to 1.49M price ranges.

Market Continuing to Build Slowly

The momentum observed in the GTA housing market since December persisted into January, fueled by decreasing fixed-rate mortgages and optimism regarding potential interest rate cuts by the Bank of Canada.

However, caution remains due to higher mortgage rates and stricter qualification criteria. Furthermore, despite the fact that there seems to be more buyer competition, purchasing power and bids have remained fairly stable. While reports of bidding wars are surfacing, the applicable properties were generally priced below market value, and sold at close to estimated market value based on comparable properties; as a result, these cases are likely not indicative of a meaningful trend, with no significant impact on average selling prices.

Current Factors and Impacts Looking Forward

Stronger-than-expected data on inflation and employment is reshaping expectations for interest rate cuts, potentially influencing the Toronto real estate market. The notable 3.4% increase in employment levels in 2023 compared to the previous year is anticipated to bolster the housing market by stimulating demand. In January 2024, the GTA housing market experienced heightened activity, driven by factors such as fluctuations in mortgage rates and prevailing sentiments regarding potential interest rate adjustments. Despite ongoing supply constraints, the impact on average selling prices remained relatively subdued. Looking ahead, the trajectory of the market will heavily depend on the dynamics of inflation, mortgage rates, and employment levels. Future trends in these areas will significantly shape the overall performance and direction of the Toronto real estate market.