Last Updated on October 24, 2023 by Neil Sharma

Home sales in Canada’s three largest cities surged last month, but RBC anticipates softening in the next few months.

“Aside from some bumps in , this summer’s broad market rally remained largely intact so far this fall,” said the bank’s report, Canada’s Housing Market was Exceptionally Strong in October. “Still, with earlier pent-up demand now entirely exhausted and tight supply poised to become more of a constraint on activity, we expect things to in the coming months.”

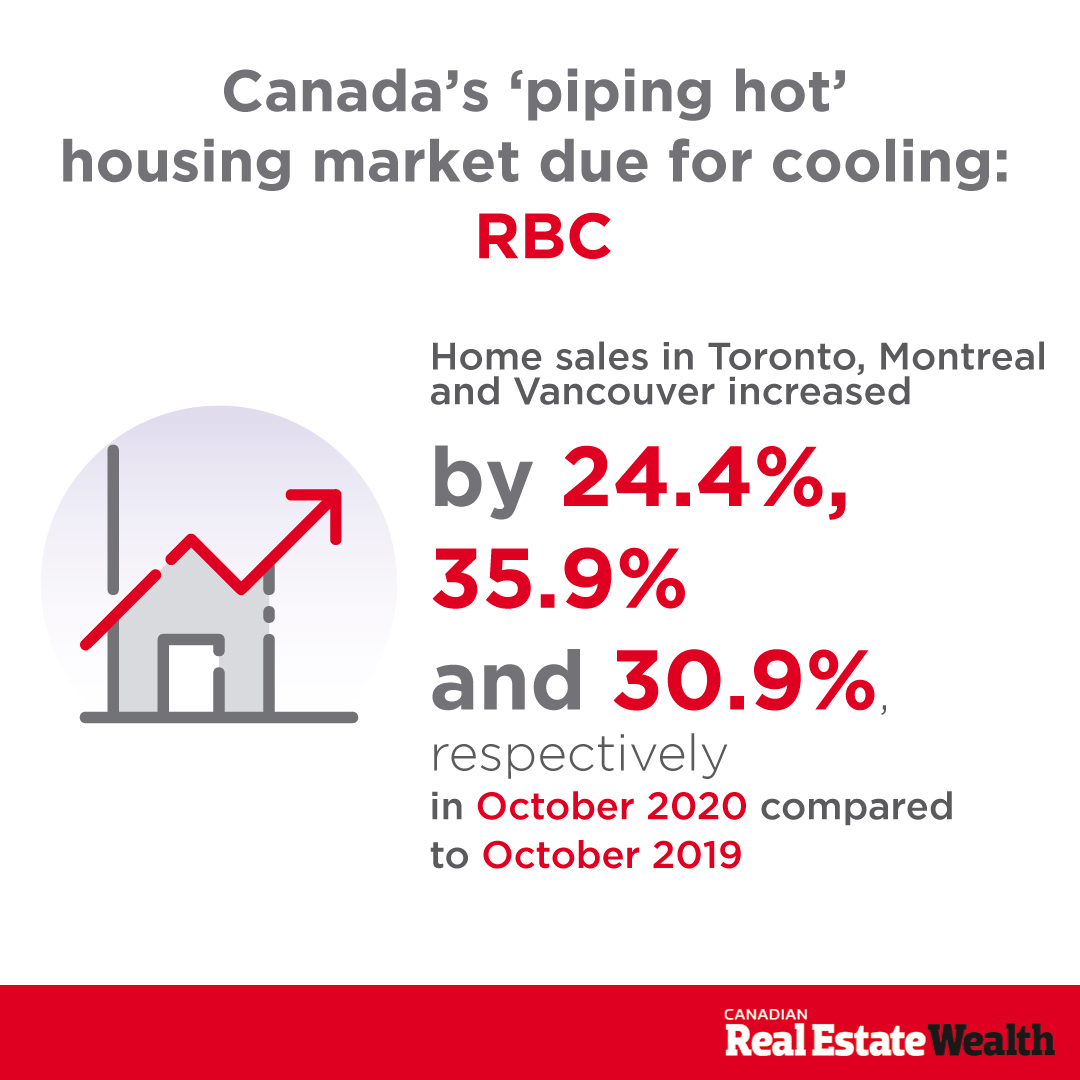

Year-over-year, home sales in , Montreal and Vancouver increased by 24.4%, 35.9% and 30.9%, respectively, in October, but with new listings rising by 16% during the same period, driven mainly by downtown condo markets, the flurry of activity could wind down.

“The downtown condo market is currently the weak spot in Canada’s housing picture,” said the report. “Many condo investors have been hit hard by the downturn in the rental market (both long-term and short-term) in Canada’s largest markets and are offloading their units. Soaring supply is tipping the scale in favour of buyers.”

The report added that condo prices have plateaued in Greater Toronto and Vancouver, and so has rental demand.

“We expect condo prices to decline further in the near term,” continued the report. “With immigration largely stalled and unemployment remaining high among lower-income Canadians, we see little that will boost rental demand in short order.”

Problems pertaining to could reemerge in the housing market, as well, because constricted supply inevitably drives prices higher.

“We expect the covid-induced market churn to fade over the coming year. As it does, supply will become even more of a constraint on overall activity. The persistence of tight overall demand-supply conditions will maintain strong upward pressure on prices—bringing affordability issues back into the fore. These factors, in our view, will slow down the pace of home resales across Canada.”

The RBC report concedes that virtually nobody could have predicted that the worst recession in generations would result in housing price acceleration, and it suggests the market could go in either direction depending on: how the burgeoning work-from-home trend continues, near-term interest rate movement, when immigration to Canada will resume, how the pandemic’s second wave and play out.

Share this Image On Your Site

Share this Image On Your Site

Neil Sharma is the Editor-In-Chief of Canadian Real Estate Wealth and Real Estate Professional. As a journalist, he has covered Canada’s housing market for the Toronto Star, Toronto Sun, National Post, and other publications, specializing in everything from market trends to mortgage and investment advice. He can be reached at neil@crewmedia.ca.